Aug 7, 2022

China’s Consumer Inflation Could Soon Surpass 3%, CICC Says

, Bloomberg News

(Bloomberg) -- The global inflation wave that largely bypassed the world’s second-largest economy may be hitting prices there after all.

China’s consumer price index has risen rapidly in the last few months and is about to exceed 3% from a year ago, according to analysts at China International Capital Corp. That would surpass the government’s target of about 3% for the year, creating a challenge for authorities already trying to balance a fragile economic recovery.

“If inflation exceeds the existing target, we think that policy makers will face the dilemma of choosing between inflation and growth,” the CICC analysts wrote in a Monday research note. “An appropriate increase in the tolerance of inflation may become a norm amid a new macroeconomic paradigm for the global economy, in our view.”

Consumer price inflation in China has remained relatively low compared to the soaring costs seen elsewhere, as demand remains depressed by strict Covid control policies and sporadic outbreaks.

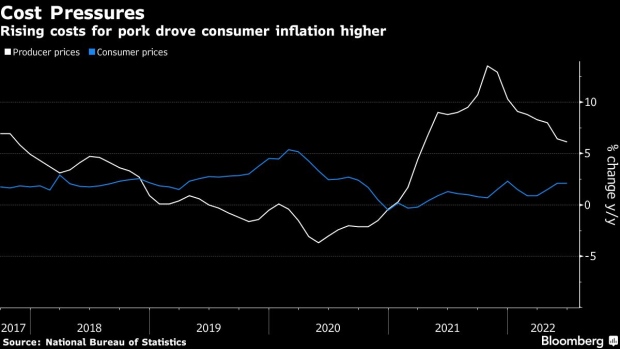

But prices have picked up in recent months, hitting 2.5% in June from a year earlier, the strongest pace in two years. China reports July inflation data Wednesday, with CPI expected to increase to 2.9%, according to the median estimate of economists polled by Bloomberg.

A big driver of China’s consumer inflation has been a rebound in pork prices, a key product in the CPI basket.

“Mainstream views contend that the hog cycle is independent, and the overall rate of inflation will not increase,” the CICC analysts wrote. “We believe this is a static analysis, and that it ignores medium-term factors that can affect inflation.”

Read More: Cutting China’s Pork Prices Means Reining In Millions of Farmers

The state economic planner has moved to contain the fast increase in pork prices, with measures including studying selling pork from state reserves and asking hog farmers not to hoard supplies.

Inflation above the government target would result in one of two scenarios for macroeconomic policy: low inflation and low growth, and appropriately higher inflation and growth, according to the CICC analysts.

“We think the second is a better option, which should benefit the healthy development of the economy and finance,” they wrote.

©2022 Bloomberg L.P.