Sep 11, 2023

China’s Credit Beats Expectations as Banks Pushed to Boost Loans

, Bloomberg News

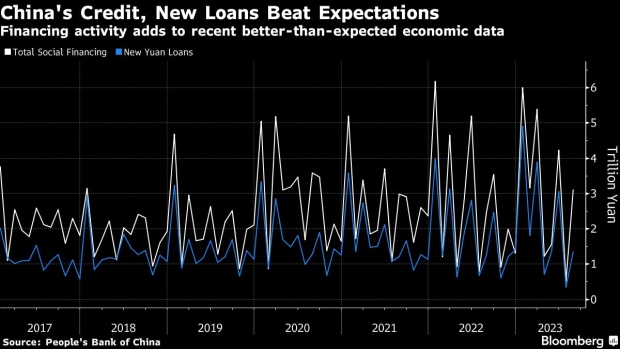

(Bloomberg) -- China’s credit expanded more than expected in August after the central bank pushed lenders to boost loans and the government accelerated the sale of bonds.

- Aggregate financing, a broad measure of credit, was 3.12 trillion yuan ($429 billion), the People’s Bank of China said Monday, higher than the 2.7 trillion yuan predicted by economists in a Bloomberg survey. Total credit was 2.5 trillion yuan in the same month a year ago

- Financial institutions offered 1.36 trillion yuan worth of new loans in the month, more than the 1.25 trillion yuan forecast by economists

Credit extension is typically stronger in August after a drop-off in the prior month, although this July’s slump was particularly steep as businesses and consumers curbed demand for loans.

The latest figures show possible signs of stabilization in household demand for mortgages after authorities took a number of steps to help bolster the real estate market. That adds to other recent indicators showing the worst of China’s economic slump may be over: exports contracted at a milder pace in August than the previous month, a key manufacturing gauge improved slightly and deflation pressure eased.

“Mortgage loans rebounded, which indicates the rate cuts and policy easing in the property sector helped to boost buyers’ sentiment,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd. “The key question is to what extent the economic momentum can be sustained. The development in the property sector remains to be the main driver for economic outlook in the rest of this year.”

The PBOC has been pushing banks to extend more loans to the private sector to help boost business confidence. Banks have also been encouraged to cut mortgage rates and China’s largest cities have been lowering down payments for homebuyers to spur the property market.

Monday’s figures showed new household mid- and long-term loans, a proxy for mortgages, was 160 billion yuan in August, reversing from the contraction in July. That suggests homeowners scaled back their early repayment of mortgages, possibly due to declining rates for existing mortgages.

The PBOC-managed Financial News published a report shortly after the data, citing unnamed people close to regulators saying the overall amount of financial support to the economy is sufficient. Structural tools will be used to solve targeted problems in the economy, according to the report.

The newspaper cited the policy support measures for the better-than-expected credit data in August, as well as an improvement in market expectations and sentiment.

Medium and long-term loans to companies, usually driven by corporate investment appetite, climbed to 644 billion yuan last month from 271 billion yuan in the previous month.

The year-on-year growth rate of broad M2 money supply slowed to 10.6% from 10.7% in July. Growth in the stock of credit rose 9%, picking up from 8.9% in July.

Local governments have also ramped up borrowing to lift spending on infrastructure projects, selling the most amount of special bonds in more than a year in August.

(Updates throughout.)

©2023 Bloomberg L.P.