Mar 10, 2023

China’s Credit Expands Faster Than Expected in February

, Bloomberg News

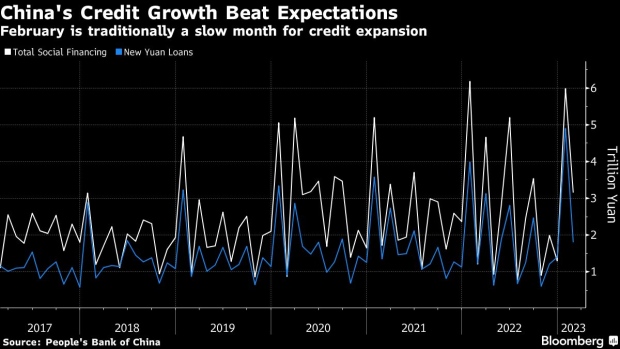

(Bloomberg) -- China’s credit grew strongly in February driven by corporate and local government borrowing, while mortgage demand from households remained subdued.

Aggregate financing, a broad measure of credit, reached 3.2 trillion yuan ($460 billion) last month, the People’s Bank of China said Friday, higher than economists had projected and almost three times the amount in February last year.

Financial institutions offered 1.8 trillion yuan worth of new loans in the month, adding to the record amount in January.

Credit expansion usually slows in February, although the earlier timing of the seven-day Lunar New holiday this year meant there were more working days last month and a pickup in economic activity.

The better-than-expected numbers “offset the recent concerns clouding the pace of economic recovery” and suggested the economic “is still on a solid footing,” said Zhou Hao, chief economist at Guotai Junan International Holdings.

The broad M2 measure of money supply expanded 12.9% from a year ago, the fastest pace since 2016. The stock of credit rose at a slightly faster pace of 9.9%, while the growth rate of yuan loans reached the highest level since January 2022.

The PBOC has urged lenders to boost loans to help support the economy’s recovery after last year’s slump, triggered by Covid outbreaks and lockdowns, and a property meltdown. With the recovery now gathering pace, the central bank’s tone appears to be shifting toward a more conservative one in recent weeks.

Liu Guoqiang, deputy governor of the PBOC, told the National People’s Congress — the annual parliamentary gathering — that the country won’t “blindly pursue fast growth of credit” as it seeks to balance maintaining economic growth and preventing financial risks, according to reports this week in local media, including Shanghai Securities News.

Governor Yi Gang also signaled last week that monetary policy will largely be stable this year.

Wang Yifeng, chief banking analyst at Everbright Securities, said the strong credit number reduces the likelihood of further interest rate cuts from the central bank this year. The PBOC will be “hesitant” to reduce the reserve requirement ratio for banks as well, he said.

The credit data last month was also boosted by strong government bond issuance, indicating increased fiscal support to the economy. Mid and long-term loans to corporates, which reflects investment demand, also climbed.

New household mid and long-term loans, a proxy for mortgages, remained well below the level in the same period in 2021, before the property sector entered a downturn. Short-term household loans, usually used for big-ticket purchases like cars, picked up strongly from January and a year ago.

--With assistance from Tom Hancock.

(Updates with additional details throughout.)

©2023 Bloomberg L.P.