Apr 11, 2023

China’s Credit Grows Faster Than Expected Following RRR Cut

, Bloomberg News

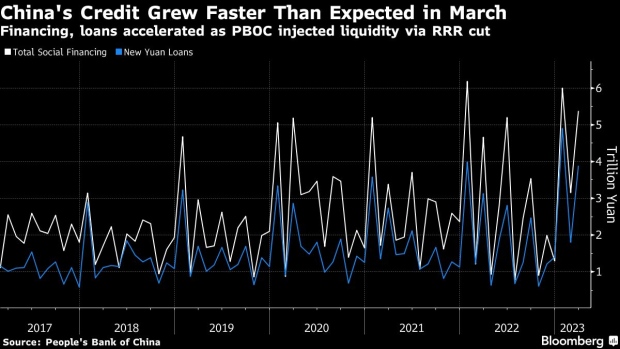

(Bloomberg) -- China’s credit expanded faster than expected in March, a sign that the central bank’s moves to unleash more long-term liquidity into the economy and support bank lending is fueling investment activity.

Aggregate financing, a broad measure of credit, reached 5.4 trillion yuan ($784 billion) last month, the People’s Bank of China said Tuesday, higher than the median estimate among economists surveyed by Bloomberg. Financial institutions offered 3.9 trillion yuan worth of new loans, also higher than expected.

New corporate mid and long-term loans — an indicator of their willingness to invest in new projects and capacities — jumped from a year ago. Government bond issuance remained robust, as local authorities have announced plans to raise spending on major construction projects by 17% this year.

Credit growth usually picks up at the end of each quarter as banks rush to meet lending targets. But lending and financing activities were also stronger than expected in the first two months of this year, as government bond issuance surged and corporate credit demand began to recover following the abandonment of Covid restrictions.

“If the trend in credit growth extends into April and May, it would translate into significant support for the economy’s recovery through investment financing,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd.

The PBOC has stepped up cash injections to help banks cope with tighter liquidity. It unleashed 500 billion yuan of long-term cash into the banking system by cutting the reserve requirement ratio last month, according to estimates by Bloomberg Economics. The central bank also added the most cash in over two years through its monthly medium-term loans operation in March.

What Bloomberg Economics Says ...

“The figures show firms are making greater use of the government’s loan supports. They also show a recovery in household demand for mortgages — another sign that the property market slump is starting to ease. We see credit growth continuing to climb in 2Q, albeit gradually, supported by a looser policy stance and a broader recovery in demand.”

— Eric Zhu, economist

Read the full report here.

The central bank could cut the RRR again around mid-year if credit growth remains high and interbank liquidity becomes tight again, according to Yeung.

Some other economists, including Bloomberg Economics’ David Qu, forecast a cut in the policy interest rate in the second quarter. Policy easing expectations continued to grow Tuesday after authorities reported weak inflation data, with bonds rallying as the yield on 10-year government notes booked the biggest one-day drop since the middle of December.

In a sign of recovering housing demand in some places, new household mid- and long-term loans, a proxy for mortgages, picked up strongly to the highest level since January 2022.

The PBOC vowed to keep “the overall quantity of money and credit appropriate with a stable growth pace” in its statement announcing the RRR cut last month. Governor Yi Gang, who was reappointed to his post in March, has signaled monetary policy will largely be stable this year, with current interest rates in the economy being “appropriate.”

--With assistance from Fran Wang.

(Updates throughout.)

©2023 Bloomberg L.P.