Nov 14, 2023

China’s Economic Activity Mixed as Beijing Steps Up Support

, Bloomberg News

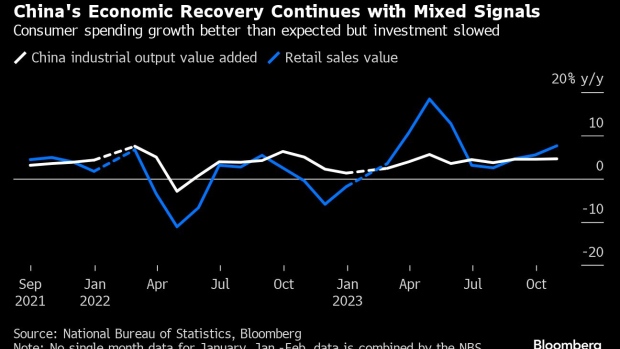

(Bloomberg) -- China’s consumer spending and industrial activity expanded faster than expected in October, but a worsening property market fueled expectations the government will have to roll out more stimulus.

Retail sales climbed 7.6% in October from a year earlier, the National Bureau of Statistics said Wednesday, a better-than-forecast result aided in part by comparisons with a contraction during the same month in 2022. October also captured the week-long Golden Week holiday period, during which Chinese travel surged, but tourist spending disappointed.

Industrial production rose 4.6%, almost unchanged from the previous month. Those figures helped offset obvious signs of weakness in the housing market: A contraction in property development investment deepened, and home sales dropped more in October than the previous month.

The data suggests China’s economy has pockets of strength such as manufacturing investment and consumer spending on electric vehicles and smart phones, putting the government’s full-year growth target of about 5% well within reach. But economists expect Beijing to add support in an attempt to stabilize the property market and improve household sentiment into next year.

“China’s economy seems to have averted fears about a broader sequential slowdown in October,” said Carlos Casanova, senior Asia economist at Union Bancaire Privee in Hong Kong.

“With that being said, the devil is in the details,” he said, noting the drag in real estate investment and adding that official strategies to restructure debt in the property sector will take several years to achieve. “Policy support is still needed in order to address concerns around domestic sentiment and housing demand.”

The CSI 300 Index trimmed an earlier gain of as much as 1.1% to close 0.7% higher, while the Hang Seng China Enterprises Index extended gains throughout the day for a 4% advance. Chinese government bonds and the yuan were little changed from the previous close.

Policymakers have stepped up stimulus to help the economy, including making an unconventional mid-year budget revision and approving 1 trillion yuan ($138 billion) worth of sovereign bonds for infrastructure investment last month.

Just before the data was released, the People’s Bank of China injected the most cash since 2016 through its medium-term lending facility on Wednesday to support government spending. Bloomberg Economics estimates that the additional policy loans will have an impact on markets equivalent to a reserve requirement ratio cut of more than 25 basis points. That’s lowering expectations the central bank will cut that requirement in the coming weeks.

Beijing is also planning to provide at least 1 trillion yuan of low-cost financing to renovate inner-city districts and build affordable housing, Bloomberg News reported. The plan, part of a new initiative by Vice Premier He Lifeng, would mark a major step-up in authorities’ efforts to put a floor under the biggest property downturn in decades.

“This year’s growth target seems to be in the bag already, but it doesn’t look like the government is being too complacent about next year,” said Adam Wolfe, emerging markets economist at Absolute Strategy Research. “It looks like they’re willing to add additional stimulus.”

The NBS highlighted the improvement in major indicators in its statement accompanying the data, adding that the economy “operated stably overall.” But it noted ongoing challenges from external uncertainties and insufficient domestic demand, adding that “foundation of the economic rebound still needs to be solidified.”

What Bloomberg Economics Says ...

“China’s headline activity data for October look rosier than the reality. Production and retail sales beat expectations on a year-on-year basis, but this was largely due to comparison with depressed figures from 2022, when the economy was struggling through the end of Covid Zero. The month-on-month numbers show weak underlying momentum is carrying over from 3Q. Overall, the data suggest more policy support is needed and is probably coming.”

— Chang Shu and David Qu, economists

Read the full report here.

Economists cautioned that consumer sentiment is still not on a sure footing. October retail sales grew at a similar pace as compared to September on a month-on-month basis, according to Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd., who added that “domestic demand is still weak.”

On a two-year average basis — which adjusts for base effects — retail sales growth slowed to 3.5% from 4% in September, according to Bloomberg calculations.

“Consumer activities remain a little bit downbeat in China because of the poor consumer sentiment, as well as the negative wealth effect coming from the property market,” said Jacqueline Rong, chief China economist at BNP Paribas SA, in an interview with Bloomberg TV.

The two-year average growth of retail sales remains far lower than its 8% pre-pandemic pace, Rong added. “It’s a quite substantial decline. The job market outlook is quite a big challenge,” she said. China’s headline unemployment rate remained unchanged from the previous month at 5%.

The weak fiscal position of local governments due to the property downturn remains another reason for stimulus. With local governments cutting back on borrowing, the fiscal deficit shrank 14% to 5.73 trillion yuan in January to October, according to a statement released by the Ministry of Finance.

Societe Generale economists estimated that infrastructure spending fell 0.2% in October. That suggests “the damage inflicted by the housing crash is too extensive to be countered by fiscally constrained local governments,” they wrote in a note. “The 1 trillion yuan already announced does not seem to be enough.”

Goldman Sachs Group Inc. economists led by Lisheng Wang also pointed to the likelihood for more support.

“Given persistent growth headwinds from the property downturn, still-fragile confidence and lingering financial risks, we think “policy put” has been triggered in China and expect the central government to step up easing materially in the coming months,” they said in a note.

--With assistance from Iris Ouyang, Zhu Lin, Ocean Hou and Alan Wong.

(Updates with details throughout)

©2023 Bloomberg L.P.