Jul 14, 2022

China’s Economy Expands at Slowest Pace Since Wuhan Outbreak

, Bloomberg News

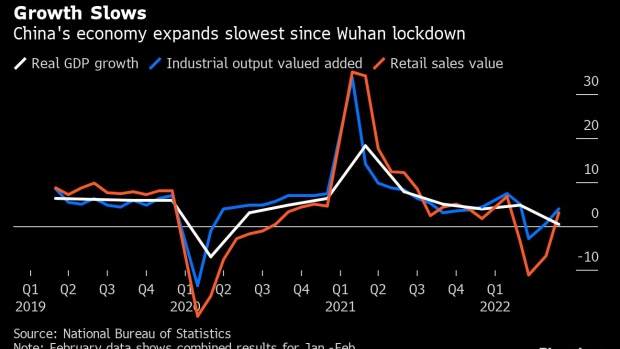

(Bloomberg) -- China’s economy grew at the slowest pace since the initial coronavirus outbreak in Wuhan, a reflection of the damage the nation’s Covid Zero approach has had on growth and the challenge Beijing faces in meeting its full-year target.

Gross domestic product increased 0.4% from a year earlier, the worst performance since the first quarter of 2020, the National Bureau of Statistics said Friday. Growth was far weaker than the 1.2% gain in a Bloomberg survey of economists. On a quarterly basis, the economy contracted 2.6%.

China’s economy is paying the price for Beijing’s attempt to stamp out Covid cases, a strategy that’s becoming ever-more difficult as more infectious virus variants emerge. On top of that, the property market remains in a deep slump. Economists say the government’s ambitious growth goal of around 5.5% is out of reach, with GDP forecast to expand just over 4% this year.

“The downward pressure on the economy has increased significantly since the second quarter,” with serious impact from unexpected factors, the NBS said in a statement Friday. “The foundation for sustained economic recovery is not stable,” it said, weighed by rising stagflation risks in the world economy, tightening of monetary policies in major economies and the impact of domestic virus outbreaks.

Friday’s data showed consumption began improving in June after financial and trade hub Shanghai emerged from its crippling lockdown and restrictions in several other cities were eased.

- Industrial output rose 3.9% in June from a year earlier, up from May’s increase of 0.7% and compared with a median estimate of 4%

- Retail sales grew 3.1%, compared with a contraction of 6.7% in May and beating a 0.3% increase projected by economists

- Fixed-asset investment grew 6.1% in the first half of the year

- The surveyed jobless rate eased to 5.5% from May’s 5.9%. For those aged 16-24, the jobless rate reached a new record of 19.3%

- Home prices fell 0.1% month-on-month in June, a slightly smaller contraction than in May

Chinese stocks held their gains after the data, with the benchmark CSI 300 Index up 0.2%. The onshore yuan gained as much as 0.3% to 6.7399 per dollar, while yields on the benchmark note were little changed at 2.79%.

While President Xi Jinping pledged in June to strive to meet China’s social and economic development targets for 2022, his unswerving commitment to Covid Zero means strict lockdowns of the kind that brought Shanghai and other places to a standstill remain an ongoing threat. That suggests an uncertain recovery for the economy in coming months and a dim possibility of a 2020-style V-shaped rebound in growth.

Premier Li Keqiang highlighted those challenges in a speech this week, saying that even though the economy is stabilizing, the foundations for the recovery aren’t solid yet and more “arduous efforts” are needed to prop up growth. He also pointed out inflation risks, saying equal emphasis should be placed on stabilizing the economy and curbing price-growth, particularly from imported sources.

Although official data showed an expansion in GDP, several high-frequency indicators suggest activity actually shrank in the quarter. Travel data showed passenger trips taken on China’s roads were mostly below last year’s levels into July, while car purchases, which make up about 10% of monthly retail sales, fell more than 10% in the quarter.

Shanghai Contraction

The NBS reported provincial GDP data as well on Friday, showing Shanghai’s economy contracted 13.7% in the second quarter from a year earlier, while Beijing’s GDP fell 2.9%.

The strength of the economy’s recovery will hinge largely on how fast authorities can bring new outbreaks under control and how much stimulus it can deploy in the second half of the year. Despite growing pressures, the People’s Bank of China has taken a cautious easing path this year, refraining from cutting policy rates since January. It has instead relied more on structural measures to support targeted sectors such as the property industry and small firms.

Earlier Friday, the PBOC refrained from injecting fresh funds into the banking system while keeping the interest rate on its one-year policy loans unchanged at 2.85%.

Beijing has been beefing up infrastructure spending to help offset the slump in growth. The government and policy banks are making 7.2 trillion yuan ($1.1 trillion) available for projects, according to calculations from Bloomberg News. Even so, economists say that won’t be enough for the government to meet its GDP growth target for the year.

(Updates with additional details.)

©2022 Bloomberg L.P.