Dec 14, 2022

China’s Equity Rally Needs Catalysts Beyond Reopening Headlines

, Bloomberg News

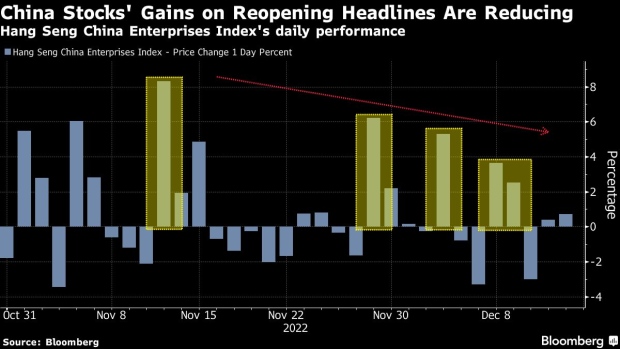

(Bloomberg) -- The epic rebound in Chinese stocks is starting to fade, signaling that investors need more than just reopening headlines to fuel the next leg of the market’s rally.

After surging more than 8% on Nov. 11, any daily gains in a gauge of China-listed stocks in Hong Kong have been lower than the previous ones, even with incremental news on reopening. Volatility remains among the highest globally and strategists are showing guarded optimism after the swift gains.

Thursday was another reminder of the challenges facing China as data showed a contraction in retail sales and industrial output last month as infections surged. With the initial euphoria surrounding reopening now gone, traders are awaiting outcomes from a key policy meeting this week and scouring economic and mobility data to assess the country’s growth potential as the economy reopens.

“People are generally skeptical about what this will mean in terms of improving economic activity considering the lifting of restrictions will probably see cases rise,” said Ilya Spivak, head of global macro at TastyTrade.

The Hang Seng China Enterprises Index is down about 4% so far this week as investors booked profits following the gauge’s jump of about 14% over the previous two weeks. Latest hawkish signals from the Federal Reserve have also put indexes in Hong Kong on course for their worst week since October.

Hong Kong-listed stocks have risen more than 30% from their latest troughs as the world’s second-largest economy relaxed its Zero-Covid policy in November. However, a full reopening could “be delayed by a large chunk of workers calling in sick as infections spread,” said Charu Chanana, market strategist at Saxo Capital Markets.

Morgan Stanley strategists including Min Dai and Gek Teng Khoo on Tuesday suggested investors pare back on reopening trades given the sharp increase in infections.

Still, many asset managers remain bullish on Chinese stocks as the potential toll on economic growth is seen as only temporary. At this point, any pullback in the market is still being considered a buying opportunity by many given the light positioning of funds in China.

China Consumers Can Add Fuel to Reopening Rally: Taking Stock

BNP Paribas SA said over the weekend that it sees gains of more than 10% in Hong Kong shares. HSBC Holdings Plc said mainland gauges will gain in line with an earnings growth estimate of about 19%.

Still, such projections from sell-side strategists for 2023 are conservative for a market that needs to almost double from current levels to get to its early 2021 peak.

“We have not even started seeing any improvement in economic data or earnings upgrades, so it seems a bit early to call it quits on this market,” said Nomura Holdings Inc.’s Asia Pacific equity strategist Chetan Seth.

The bank said the MSCI China Index could hit the 71.5 level before investors reassess further advances, indicating about a 10% increase from Wednesday’s close.

“Incremental newsflow might not be enough to cause another spike upwards. As we have seen in other reopenings, cases surged at the start and hospitalizations rose as well,” said Christina Woon, investment director for Asian equities at abrdn plc.

“We have to watch how the government manages this. Any backtracking now will be bad for sentiment and the market is very wary of that.”

(Updates throughout.)

©2022 Bloomberg L.P.