May 16, 2023

China’s Home-Price Growth Slows as Housing Rebound Fizzles

, Bloomberg News

(Bloomberg) -- China’s home price growth slowed in April, underscoring the challenges the market is facing following a brief recovery.

New-home prices in 70 cities, excluding state-subsidized housing, rose 0.32% last month from March, when they grew 0.44%, National Bureau of Statistics figures showed Wednesday. Price gains slowed to just 0.01% in the secondary market, after climbing 0.26% a month earlier.

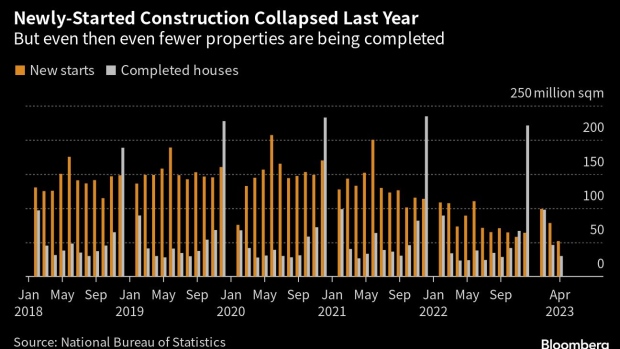

Signs of weakness are emerging in the residential property market after sales and prices rebounded briefly following a historical slump of about 18 months. High-frequency indicators in recent weeks show momentum in home purchases has fizzled, despite Beijing’s effort to prop up the market.

“Property policies will likely remain loose in the short term,” said Chen Wenjing, associate research director at China Index Holdings. “It’s vital to maintain confidence of prospective homebuyers.”

More efforts are needed to stabilize the housing market, Fu Linhui, spokesman of China’s National Bureau of Statistics, said at a media briefing on Tuesday after multiple April economic figures came in lower than expected.

New household mid and long-term loans, a proxy for mortgages, posted the first decline in a year in April, suggesting residents repaid more than they borrowed.

China’s property sector is key for the economic growth outlook this year, as it accounts for about 20% of the country’s gross domestic product after including related industries. The fate of the sector also weighs on the global economy, as it helps drive demand for commodities like iron ore and copper.

With policy support, property-related credit could stabilize gradually as household income improves, said UBS Group AG’s chief China economist Wang Tao. On Monday, ratings firm Moody’s Investors Service upgraded the sector’s outlook to stable from negative, as it expects property sales to stabilize in the next 12 months.

©2023 Bloomberg L.P.