Jul 11, 2022

China’s Imports of Key Commodities Set to Make a Patchy Recovery on Growing Mobility

, Bloomberg News

(Bloomberg) -- China’s imports of key commodities probably improved in patches last month, after demand was battered earlier in the quarter by shutdowns in Shanghai and elsewhere in the country.

Greater mobility among the population may have seen crude oil imports edge higher, but coal and gas purchases are likely to have stayed weak, capped by surging international prices and elevated domestic production. Imports of farm goods probably benefited from a sharp retreat in global prices.

Among metals, copper imports are expected to post a modest pickup even though demand remains sluggish. Shipments of concentrate may have dropped from the record set in May. Iron ore arrivals were likely steady as traders continued to eye forecasts of a lift in infrastructure spending. Aluminum exports could also have fallen from their May record as overseas demand wanes amid recession fears.

The backdrop to the trade figures on Wednesday will be revealed in the GDP report at the end of the week, which could show that the economy shrank in the second quarter as virus restrictions exacted a heavy toll. And as Shanghai nervously eyes the threat of another round of lockdowns, it’s clear that the government’s rigid adherence to Covid Zero will continue to cast a pall over consumption as the second half gets underway.

Events Today

(All times Beijing unless shown otherwise.)

- LME Asia Metals Seminar, online from 13:10

- China farm ministry’s monthly crop supply-demand report (CASDE)

- USDA’s monthly world crop supply-demand report (WASDE), 12:00 EST

Today’s Chart

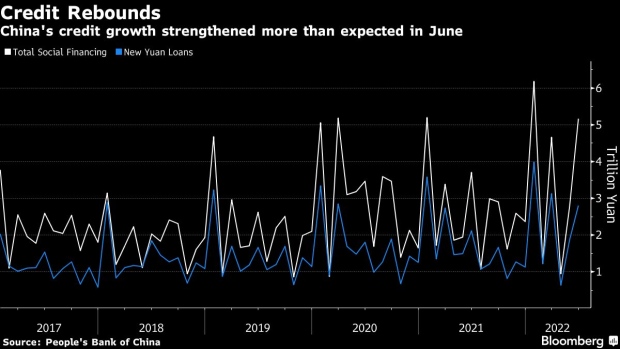

China’s credit growth jumped much more than expected last month to the highest on record for June, as government stimulus to repair the damage caused by virus restrictions flowed to the economy.

On The Wire

Shanghai’s reopening in June appears to have eased supply chain snarls -- for both China and the world.

The Week Ahead

Wednesday, July 13

- Tianqi Lithium to list shares in Hong Kong

- China to set this month’s 1-year MLF rate by June 16

- China’s 1st batch of June trade data, incl. steel, aluminum & rare earth exports; steel, iron ore & copper imports; soybean, edible oil, rubber and meat & offal imports; oil, gas & coal imports; oil products imports & exports. ~11:00

- China Offshore Wind Power Conference, Guangzhou, day 1

Thursday, July 14

- China International Lithium & Cobalt Industry Chain Development Forum, Chengdu, day 1

- Jiangsu Solar Industry Development Forum, Nanjing, day 1

- China Offshore Wind Power Conference, Guangzhou, day 2

- USDA weekly crop export sales, 08:30 EST

Friday, July 15

- Rio Tinto quarterly production report, 08:30 Sydney

- China new home prices for June, 09:30

- China June output data, incl. steel & aluminum; coal, gas & power generation; and crude oil & refining, 10:00

- Retail sales, fixed assets investment, property investment, residential property sales, jobless rate

- 2Q GDP

- 2Q pork output and inventory levels

- Retail sales, fixed assets investment, property investment, residential property sales, jobless rate

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- China International Lithium & Cobalt Industry Chain Development Forum, Chengdu, day 2

- Jiangsu Solar Industry Development Forum, Nanjing, day 2

- China Offshore Wind Power Conference, Guangzhou, day 3

Saturday, July 16

- China International Carbon Trading Conference, Shanghai

©2022 Bloomberg L.P.