Mar 14, 2024

China’s Teapot Oil Refiners Slash Output as Industrial Demand for Fuel Fizzles

, Bloomberg News

(Bloomberg) -- China’s uncertain economic prospects are stressing the oil refiners that produce diesel, the fuel that powers much of the country’s industrial activities.

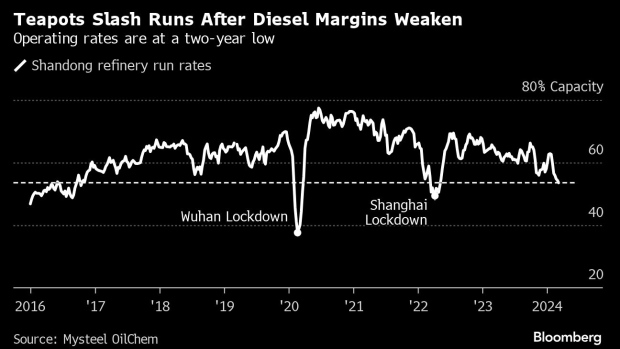

Operating rates at smaller, private refineries clustered in Shandong province — dubbed teapots — have fallen to a two-year low. Strip out the Shanghai lockdown and the start of the pandemic, and runs haven’t been this feeble since 2016. Diesel is the teapots’ main product.

The pressures on refiners are familiar across commodities markets, and revolve around a collapse in demand from the housing market. But Chinese manufacturing has also been in contraction since September, while policy support has been sluggish. The government’s annual policy-setting meeting that concluded this week hasn’t fostered much optimism that its 5% growth target for the year can be met without additional stimulus.

Trucks, diggers and power lifters all run on diesel, which is also often used by factories for backup generators. Prices have dropped to their lowest since July. By cutting production, teapots are trying to keep margins respectable — they’re hovering around their 10-year average, according to Mysteel OilChem — but volumes are being sacrificed as a consequence.

“Downstream demand for diesel, from mining to infrastructure, is seriously lagging expectations,” Zhang Xiao, an analyst at Mysteel OilChem, said at a briefing on Tuesday. Consumption from the logistics sector is the one exception, she said, although liquefied natural gas is rapidly displacing the fuel in trucking.

The teapots in Shandong account for about a quarter of China’s refining capacity. They don’t have the scale of the state-owned giants and are typically more sensitive to market prices. They’re also suffering from poor margins on bitumen, used to tar roads, and higher crude oil costs.

Some relief may be around the corner with the spring harvest — diesel also powers farm equipment — as well as the threat that the US will resume sanctions on Venezuela, according to Jianan Sun, an analyst with Energy Aspects Ltd.

Fewer international buyers of Venezuelan oil mean cheaper prices for teapots, which are happy to take sanctioned crude.

On the Wire

In a world where electric vehicles and utility-scale batteries are taking over, it would be nice to not depend on a geopolitical rival for your most important raw material.

China has pledged central government funds to encourage consumers and businesses to replace old equipment and goods, a pillar of its plan for economic growth of about 5% this year.

Copper spiked to an 11-month high after Chinese smelters pledged to explore measures to cope with a plunge in processing fees, including possible production cuts that could leave buyers under-supplied.

Chinese coal imports will likely be suppressed in April and May amid weaker domestic prices and higher costs for overseas supplies

The Week’s Diary

(All times Beijing unless noted.)

Thursday, March 14:

- China to release February aggregate financing & money supply by March 15

- CRU Group webinar on China’s metals outlook, 16:00

- Mysteel hosts international iron ore conference in Qingdao, day 2

- EARNINGS: Rusal

Friday, March 15:

- China sets monthly medium-term lending rate, 09:20

- China new home prices for February, 09:30

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- Mysteel hosts international iron ore conference in Qingdao, day 3

- EARNINGS: CATL

©2024 Bloomberg L.P.