Jan 6, 2023

China Stock Traders Bet Consumption Will Supercharge 2023 Rally

, Bloomberg News

(Bloomberg) -- Chinese equities have been on a tear in the first week of 2023, and investors are gearing up for more gains with consumer-related stocks expected to spearhead the surge.

Across trading floors on the mainland, optimism around the reopening trade is rebuilding. The speed at which infections appear to have peaked in some cities has caught many money managers by surprise, spurring bets that pent-up demand will help revive growth and corporate profits.

“Consumption is for sure going to be at the forefront of a Covid recovery boost, helped by price hikes as the stifled demand comes roaring back, while confidence and employment pick up, said Shi Peng, managing director at Loyal Capital Ltd. in Tianjin.

China’s mainland stock benchmark climbed almost 3% this week, beating a global gauge, as traders position for a resumption in economic activity. Easing regulatory risks and support measures for the property sector lent an additional boost. A measure of US-listed Chinese shares had its best-ever start to a year after a relentless rout that erased more than half of its value over the last 24 months.

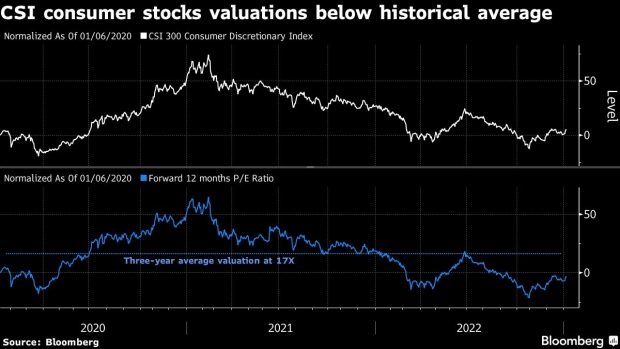

The CSI 300 Consumer Discretionary Index outperformed the benchmark this week, climbing 3.9%. Some of the biggest gainers were retail-related names such as auto parts producer Huizhou Desay Sv Automotive Co. and appliance maker Beijing Roborock Technology Co.

“Consumption is the last resort now for the economy, and the market is likely to favor the theme as the low-base effect means that the numbers will look solid, to say the least,” said Yu Yingbo, investment director at Shenzhen Qianhai United Fortune Fund Management Co. “The reopening story will be lasting, and can be played throughout the year.”

More broadly, the CSI 300 Index has risen more than 13% since the end of October after a surge in infections emptied streets, shuttered stores and brought equity trading to a standstill. A gauge of Chinese stocks listed in Hong Kong has fared even better, rallying 45% in the period as authorities stepped up support for the beleaguered property sector.

The two measures are still more than 30% below their 2021 peaks.

Some 90 cities out of a 101-city sample have seen continuous improvement in intra-city mobility, up from 49 a week ago, according to a note from Bank of America.

“It’s likely the Covid spread has peaked ahead of schedule, and we look forward to a robust consumption recovery in services during the spring festival,” Huaan Securities analysts including Zheng Xiaoxia wrote in a note. Consumer stocks will lead the gains, before growth shares take over amid expectations for policy announcements to be unveiled at two government meetings in March, they wrote.

To be sure, several risk factors remain: more Covid waves could follow, the number of severe cases is still elevated and deaths are mounting. Some warn that a further rally may be punctuated by bouts of volatility.

“Growth this year hinges on consumption and what can be done, especially on the fiscal front, to help people to get over their scars and spend again,” said Wang Huan, managing director at Shanghai Zige Investment Management Co. “The market has not fully priced in the fact that we’ve pulled through the first wave, but I’m not so hyped up to anticipate that it will be one-way up — there will likely be cycles of cheer and dejection.”

With sentiment improving, trading activity has also picked up. Daily average turnover in Shanghai and Shenzhen rose to over 800 billion yuan ($117 billion) this week, although it’s still below the level seen in early December.

Global investors loaded up on 20 billion yuan of A-shares in the biggest weekly inflow in over a month.

“Signs of earlier macro bottoming out post Covid, committed stimulus policy, further currency strengthening, as well as near-term stabilization of geopolitical uncertainty should warrant greater allocation into China,” Morgan Stanley strategists including Laura Wang wrote in a note dated Jan. 5, reiterating their overweight stance on China.

©2023 Bloomberg L.P.