Jan 20, 2023

China Stocks on Cusp of Bull Market as Year of the Tiger Ends

, Bloomberg News

(Bloomberg) -- China’s equity benchmark ended little shy of a bull market heading into a weeklong break, as foreign investors continued to buy local shares on the back of the nation’s economic reopening and pro-growth policies.

The CSI 300 Index rose 0.6% on Friday, capping a fourth straight week of gains. The gauge has surged a little more than 19% from an Oct. 31 low, led by consumer stocks and financials, as investors bet on an outburst of retail spending and improved business environment following President Xi Jinping’s moves to exit Covid Zero and focus on growth.

Everyone from Wall Street strategists to global money managers and even some sovereign wealth funds has increasingly turned bullish on Chinese stocks as economists upgrade their forecasts for economic growth this year. A return of overseas buyers is supercharging mainland shares after they lagged their Hong Kong-listed peers in the reopening rally that began in November.

This bullish backdrop heading into the Lunar New Year holidays is a far cry from 12 months back. Chinese stocks were suffering at this point in 2022 — with the CSI 300 staring at a bear market — as they got battered along with other markets amid fears over US rate hikes.

“China reopening is becoming a crowded view, but not yet a crowded trade,” said Qi Wang, chief executive officer at MegaTrust Investment in Hong Kong. “In hindsight, Wall Street investors were too bearish and underestimated the pace of reopening.”

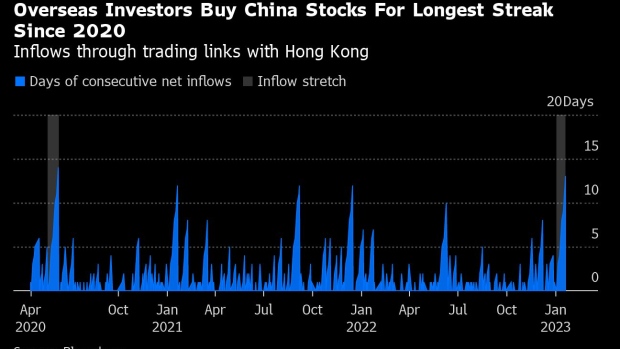

Global funds were net buyers of shares listed in Shanghai and Shenzhen for a 13th straight day on Friday, the longest purchasing streak since May 2020. They have raised their holdings by 112 billion yuan ($16.5 billion) in January, on pace for a monthly record, according to data compiled by Bloomberg.

China’s economy will rebound to its pre-pandemic growth trend this year as virus infections have passed their peak, Vice Premier Liu He said at the World Economic Forum’s annual meeting this week. Recent data showed the economy was more resilient at the end of 2022 when a virus wave swept the nation.

Sentiment is also getting a boost from a series of property support measures. The latest report showed the nation’s financial regulator and bad-debt managers are beefing up refinancing support for high-quality developers.

The CSI gauge is up 8% so far in 2023 after capping its first back-to-back annual losses since 2011 last year.

The Hang Seng China Enterprises Index of Chinese stocks listed in Hong Kong — which suffered more during the relentless equity selloff — has rebounded faster and entered a bull market in November. That measure climbed 2.3% on Friday and is up almost 12% this year. Trading in Hong Kong stocks will resume on Jan. 26.

“Foreign investors are really materially underweight China equities, and this is material, because we don’t have to worry about investors selling the rally,” George Efstathopoulos, a portfolio manager at Fidelity International, said in an interview. “We think earnings bottomed out last quarter.”

--With assistance from Ishika Mookerjee.

©2023 Bloomberg L.P.