Mar 12, 2020

Cineworld plummets as it outlines worst-case scenario for virus

, Bloomberg News

Cineworld Group Plc, the world’s second-biggest cinema company, plunged by a third after it said its worst-case scenario for the coronavirus outbreak could put it at risk of breaching lending covenants.

The drop brought the stock’s year-to-date decline to 73 per cent. Cineworld has not seen a material impact from the pandemic, it said in a statement Thursday.

In a scenario where the virus impact causes a loss of as much as three months revenue, an inability to reduce its fixed costs to cope with site closures, and other assumptions, Cineworld would be at risk of breaching debt covenants. The company has a credit line whose terms can be triggered when it is more than 35 per cent drawn, and loans with terms related to net debt to earnings ratios.

“I am of course conscious of the possibility that events could develop adversely very quickly and change this position in the short term, but I remain confident that the crisis will ultimately pass,” Chairman Anthony Bloom said in the statement.

However, investors had already been betting against the chain: it was popular with short-sellers even before the scale of the coronavirus outbreak began to roil markets, due to a weaker film slate than recent years and the surge of streaming services like Netflix Inc.

Cineworld has planned measures to mitigate any hit if customers are forced to stay home, including delaying capital spending and cutting costs to maintain cash liquidity.

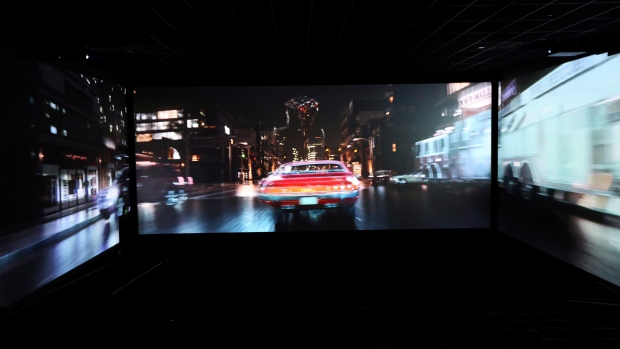

The most recent bad omen was the delay of the new James Bond blockbuster ‘No Time to Die’ to November from April. Analyst Ivor Jones at Peel Hunt said the top 10 movies account for about 40 per cent of box-office revenue in a typical year, and the Bond delay was unlikely to be the last. Shares in Cineworld’s rivals like Cinemark Holdings Inc., IMAX Corp. and AMC Entertainment Holdings Inc. have also fallen.

Analysts at Peel Hunt said Cineworld should abandon its deal to acquire Canadian chain Cineplex, given the market turbulence. The company said in Thursday’s statement it expects to complete the acquisition.