May 27, 2022

Citi Says Go Underweight Yuan With Risk Assets Still Vulnerable

, Bloomberg News

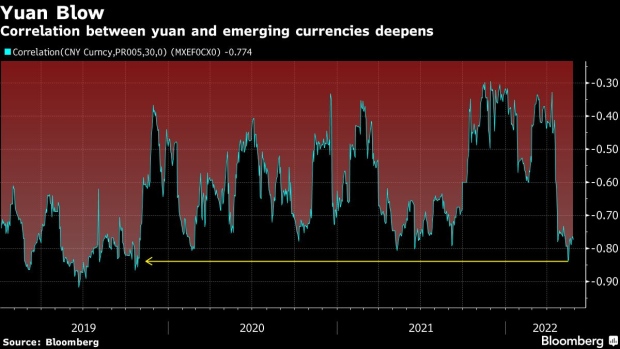

(Bloomberg) -- Citigroup Inc. is advising investors to limit exposure to the yuan and remains cautious on emerging markets more broadly, saying China hasn’t done enough to ease the risk that its economic slowdown will threaten growth worldwide.

China’s deepening slump, fears of a US recession and the Federal Reserve’s moves to shrink its balance sheet mean that any correction in risk assets are likely to be temporary, according to Citigroup. After sliding to lows not seen since 2020, emerging-market currencies, bonds and stocks are poised for their second week of gains amid a pullback in the U.S. dollar and Treasury yields.

Global currency markets appear to be experiencing “a reshuffle” in depressed high-yield positioning “rather than the beginning of a structural weaker broad dollar trend,” Citigroup strategists including Dirk Willer and Luis Costa wrote in a report. “Arguably bearish equity and long dollar positioning has built up rapidly and at risk of flash reversals but the direction of travel seems for further weakening of risk assets.”

Chinese Premier Li Keqiang’s plea this week for officials to move decisively to prevent the economy from backsliding and the nation’s grim economic data highlight the risks the world’s second-largest economy is facing amid stringent covid lockdowns, a property credit crisis and waning exports. Citigroup slashed in May its GDP forecast for China to 4.2% from 5.1%.

“Markets may start trading a China re-opening, but that may be too soon,” Willer and Costa said. “Despite the ongoing drag from zero covid policies and weak growth numbers, stimulus has been very piecemeal and policymakers seem reluctant to commit to measures.”

Citigroup also expects declines in the Indian rupee against the dollar and the South Korean won versus the yen. It is also betting against the Turkish lira and South African rand relative to the dollar in its model portfolio. In Latin America, it sees gains in the Brazilian real versus the Colombian peso.

For now, there may be a “bear-market rally in the making” for emerging-market credit if U.S. yields continue to consolidate, equity volatility declines further and the dollar’s weakness persists, according to the strategists. Valuations are attractive for sovereign bonds in nations such as Brazil, Mexico and Colombia, and emerging-market investors seem to have large cash buffers, they said.

©2022 Bloomberg L.P.