Apr 13, 2023

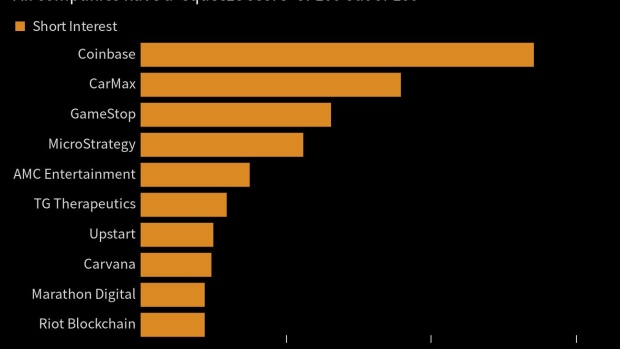

Coinbase, CarMax, GameStop Lead List of Most ‘Squeezable’ Stocks

, Bloomberg News

(Bloomberg) -- Traders betting against the shares of Coinbase Global Inc., CarMax Inc. and GameStop Corp. should be on high alert: The stocks are all prime candidates for a short squeeze that could stick these speculators with steep losses.

The three firms sit atop a list of companies that S3 Partners LLC gives its highest “Squeeze Score” of 100, meaning they’re the most in danger of an event forcing traders to swiftly exit positions, a move known as short covering.

The past month’s rally in US stocks “has made short positions more crowded and more squeezable as the mark-to-market value of shorted shares increases,” Ihor Dusaniwsky, managing director of predictive analytics at S3, wrote in an April 12 note.

The score that S3 Partners generates measures components such as higher financing costs and unrealized losses against how crowded each trade is. A score above 70 indicates trouble, one that’s 90 or above represents a “significantly higher risk of a squeeze,” and 100 is the peak warning level, according to Dusaniwsky.

A high squeeze score doesn’t guarantee that one will happen, but a stock can’t be squeezed without one, as it indicates the extent of short-sellers’ exposure, Dusaniwsky said.

Coinbase leads the list because its outstanding $2.7 billion in short interest is the largest of the group. In the 30 trading days through Tuesday’s close, traders wagering that it will decline have a mark-to-market loss of nearly 26%, according to the report. The shares have climbed more than 31% in that timeframe.

CarMax, which placed second, has short interest of $1.8 billion and a mark-to-market loss of about 14% in the last 30 days as the stock rose more than 13%. MicroStrategy has surged more than 73% in that period, fueling a loss of nearly 52% for short-sellers on a $1.1 billion position.

Rising stock prices aren’t the only thing that can potentially force short covering. AMC Entertainment is up only 1% during the period, but has a high borrowing fee of nearly 238%, adding pressure to short sellers.

©2023 Bloomberg L.P.