Sep 6, 2022

Companies Are Rushing to Sell Bonds Before It Gets Even More Expensive

, Bloomberg News

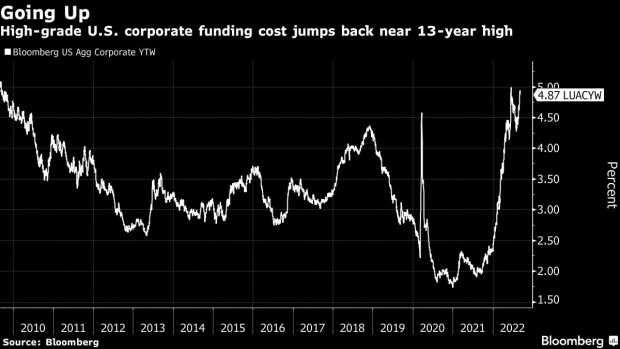

(Bloomberg) -- US companies extended a worldwide wave of issuance, offering the largest amount of bonds in 12 months amid rising borrowing costs.

Nineteen issuers are selling bonds Tuesday, with $30 billion to $40 billion of new supply expected to price. That’s the most since last September and comes after an almost 60-basis-point jump in high-grade yields since Aug. 1.

The newfound urgency to raise debt is sparked by the potential for greater uncertainty -- and higher cost -- after this month’s meeting of the Federal Reserve Federal Open Market Committee.

“There’s a catalyst to go at the beginning of the month with the FOMC on the 21st and a number of folks trying to go ahead of the inflation print on the 13th,” said Teddy Hodgson, co-head of global investment-grade syndicate at Morgan Stanley. “We think the first two weeks of September might be equally busy.”

Walmart Inc., Target Corp., Lowe’s Cos., McDonald’s Corp, Mondelez International Inc., Nestle SA and Union Pacific Corp. are among borrowers in the investment-grade market Tuesday.

Wall Street expects about $50 billion of blue-chip bond sales this week and $150 billion for the month of September, according to an informal survey of debt underwriters. Tuesday’s big tally means those forecasts could well be exceeded.

The glut of corporate sales weighed on Treasury prices -- further increasing funding costs -- due to rate locking and hedging. US Treasury yields surged more than 15 basis points on Tuesday, amid selling across the curve.

In Europe, issuance soared to the highest since January, with more than 24 billion euros ($23.8 billion) in volume. France and Italy led Tuesday sales, which included eight deals from financial groups and four covered bonds.

Asia had its busiest day in three months, as companies stung by this year’s credit rout seized the chance to issue debt after yields dropped in August. In addition to US-currency offerings from Mitsubishi UFJ Financial Group Inc. and Sumitomo Mitsui Trust Bank Ltd, HSBC Holdings Plc marketed a Samurai bond.

Read More: Asia Joins Global Bond Deals Rush With Busiest Day Since June

Junk Start

In high yield, two new sales kicked off in the leveraged loan market as banks look to offload debt sitting on balance sheets after a lull in issuance over the US summer.

A group of banks led by Deutsche Bank AG announced a $1.525 billion seven-year first-lien term loan to fund the buyout of animal health company Covetrus Inc. by private equity firms Clayton, Dubilier & Rice LLC and TPG Capital LP. That followed a Friday launch of a dollar-denominated 1 billion euro first-lien term loan for UK sports-betting firm Flutter Entertainment Plc, to finance its acquisition of Italian gambling operator Sisal SpA.

Investors are also awaiting the loan portion of a $15 billion buyout financing for Citrix Systems Inc. Bank of America Corp. has told investors it will kick off the sale this week.

Elsewhere in credit markets:

Americas

Bankers trying to sell the buyout financing of Citrix to investors are floating a yield in the high-8% range for the secured junk-bond portion, according to people with knowledge of the matter.

- RXR has landed a $1.3 billion loan refinancing for a Times Square office tower as it ramps up building improvements to attract new tenants

- Investment firm Hamilton Lane Inc. has raised $953 million for its latest private-credit fund

- Alex Bea, head of distressed debt and special situations at JPMorgan Chase & Co., is leaving the firm, according to people with knowledge of the matter

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

Banks are preparing to offer a debt package of around 1.3 billion euros to finance Bain Capital Private Equity’s majority buyout of House of HR.

- Anglian Water Group Ltd is set to become the first UK water company to test the public debt markets since a summer in which the sector came under intense public criticism for chronic leaks and sewage discharged into the nation’s rivers and seas

- Tuesday’s issuance tally will go some way toward the over 30 billion euros expected by 50% of respondents to the most recent Bloomberg survey

- The ECB meeting on Thursday is likely to keep issuance at bay that day

- HSBC Holdings Plc jumped six rungs in a ranking of corporate bond arrangers, challenging long-term leader BNP Paribas SA after winning several major deals this year

Asia

At least six companies in the region marketed notes in US dollars, the busiest day since June 8, according to Bloomberg-compiled data of deals with a minimum size of $100 million.

- Half of the issuers were from Japan, including MUFG and Sumitomo Mitsui

- Two other firms have hired banks for possible dollar debt sales in the near future

©2022 Bloomberg L.P.