Feb 26, 2024

Convertibles Notch $5 Billion Week as Rate Cuts Appear Distant

, Bloomberg News

(Bloomberg) -- A long-awaited wave of convertible bonds made landfall last week, with Global Payments Inc. and Lyft Inc. among the companies tapping investors for relief from the so-called maturity wall at relatively attractive prices.

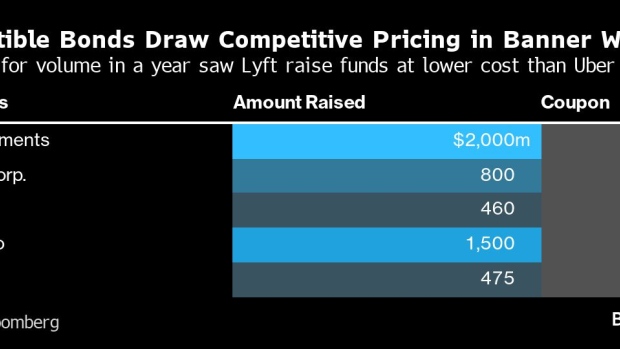

Convertible issues had their busiest week in a year, with five issues raising a combined $5.18 billion in the seven-day period ending Friday, according to data compiled by Bloomberg. That’s just shy of the $5.99 billion raised in the week of Feb. 20 last year.

With US companies of varying creditworthiness facing $812 billion worth of maturing debt this year, according to S&P Global Ratings, and once-widely-expected interest rate cuts from the Federal Reserve now looking less imminent, convertibles’ generally lower cost of financing than straight debt is drawing in issuers keen to refinance existing borrowings. That could push annual US volume to as much as $65 billion, 20% higher than 2023’s total, Bank of America Corp. research shows.

“The recent economic data are causing issuers to re-consider their issuance plans,” said Syed Raj Imteaz of ICR Capital LLC. “If a significant rate cut is not in the cards, why wait to issue? Why not go to the market now?”

Super Micro Computer Inc.’s $1.5 billion, five-year convertible bond issue — which ICR advised on — was priced at 0%, the first US dollar-denominated convertible to do so since Confluent Inc.’s $1.1 billion convertible in December 2021, before the interest rate hike cycle began.

Even though the near-term catalyst for the jump last week was companies waiting to announce their fourth-quarter earnings, the overriding motivation is to refinance existing obligations at lower rates, helped by an asset whose convertibility into shares benefits when stock markets are touching record highs.

The surge is “a great example of how companies, when being opportunistic, can quickly take advantage of lower cost of capital when being public,” said Steve Maletzky, group head of capital markets for William Blair & Co.

Stronger-than-expected economic data and recent comments by Federal Reserve officials have encouraged potential issuers to face the higher-for-longer reality head on.

“The uptick in convertible deals last week — a majority of which was used to refinance existing debt — is a sign that issuance from the often-discussed maturity wall is beginning to materialize,” said Steve Streit, a portfolio manager with Acasta Partners.

Enticing Investors

Bank of America, an underwriter on all five of last week’s convertible issuances, expects volume in the US to be between $60 billion and $65 billion this year, versus $54.67 billion in 2023, and sees a wider variety of issuers — which may prove more enticing to investors.

“Last year, we saw a lot of paper from utilities companies, which, while good with strong credit, are less interesting for convert investors because their volatility is low, making it harder to make money,” said Michael Youngworth, Bank of America’s head of global convertibles and preferreds strategy.

Ridesharing app company Lyft was met with favorable terms, pricing its $460 million, five-year issue at 0.625%, lower than the 0.875% coupon for Uber Technologies Inc.’s upsized $1.725 billion convertible in November last year.

The timing may have helped. “Those companies that come to market at the beginning of the issuance wave generally get better terms than those that wait longer,” Youngworth said.

Investment grade companies accounted for just under a third of the new convertibles so far in 2024, versus about a quarter last year, according to Bank of America. They include Federal Realty Investment Trust’s $485 million issue and Global Payments’ $2 billion worth of notes.

©2024 Bloomberg L.P.