Mar 4, 2021

Copper, Nickel Extend Plunge With Federal Reserve Standing Pat

, Bloomberg News

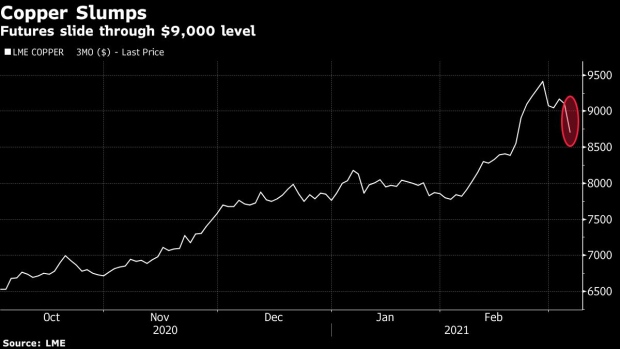

(Bloomberg) -- Copper fell the most since March and nickel extended a slide, accelerating a selloff in industrial metals that a reversed recent weeks of stellar gains.

The slump that was sparked in part by a rise in inventories tracked by the London Metal Exchange and easing nickel supply concerns eased was spurred further by rising treasury yields and a strengthening dollar. U.S. Federal Reserve Chairman stopped short of pushing back on a surge in yields, sparking a broad selloff across equities and metals.

Copper and nickel have attracted the most investor interest among metals in recent months, with bets on a boom in prices driven by the rise of electric vehicles and a global move toward low-carbon power sources. Nickel, a key battery metal, fell by the most in four years and headed for its biggest two-day loss in a decade, just after reaching a six-year high last week.

“The renewed rise in yields and the dollar, together with continued stock-market weakness, have triggered a more aggressive round of long liquidation across commodities,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. “We are now also seeing darlings like copper starting to suffer.”

Copper slumped as much as 5.8%, after surging in recent weeks on speculation that the metal used in EVs and solar power systems will benefit from green stimulus measures. One Chinese brokerage lifted its long bets on copper about 700% in four trading days, building up a $1 billion position.

Last week, nickel hit a six-year high above $20,000 a ton, while copper traded only a few hundred dollars shy of its all-time high of $10,190.

Nickel has fallen about 14% in the past two days after a major Chinese producer’s unexpected plan to add supply eased concerns about a structural deficit. China’s Tsingshan Holding Group Co. agreed to provide nickel materials for electric-car batteries to Huayou Cobalt Co. and CNGR Advanced Material Co., according to a post on Tsingshan’s WeChat account.

News that “Tsingshan will mass-produce nickel matte could be a game-changer,” said Wenyu Yao, senior commodities strategist at ING Bank. “The risks of battery-grade nickel supply are much reduced. Until a new market equilibrium is found, exchange-traded nickel looks bearish in the short term.”

Still, many traders and investors are still optimistic for the outlook for the metals.

“Today is a time for hard hats,” Alastair Munro at Marex Spectron said in a note. “There remains a strong micro argument for some of these metals. And there remains a strong argument to be long given the raft of stimulus measures the world is set to unleash.”

Copper for three-month delivery on the LME fell 2.1% to settle at $8,907.50 a ton, after touching $8,570 in late trading. Nickel fell 7.4% while all other main metals declined.

©2021 Bloomberg L.P.