Mar 22, 2023

Credit Risks Take Center Stage as Traders Boost Fed-Cut Bets

, Bloomberg News

(Bloomberg) -- Bond traders are zeroing in on just how much the ongoing turmoil in the banking system might tighten credit conditions and hurt the US economy, potentially forcing the Federal Reserve to change tack and cut interest rates.

Shorter-dated Treasury rates extended their decline Thursday following a slump the day before in the wake of the latest Fed decision. The moves came after the US central bank tempered its language around how much additional tightening it might do, even as it implemented another quarter-point hike.

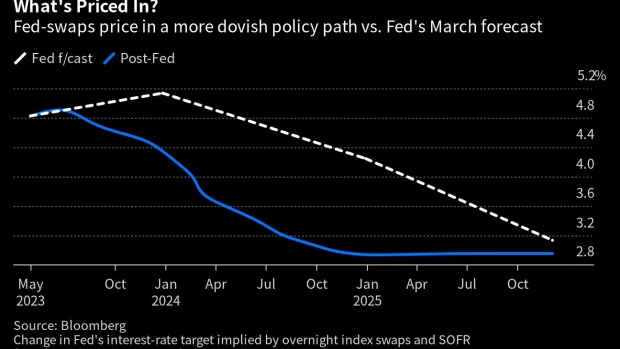

The three-year Treasury yield is around 35 basis points below where its stood the day before the Fed decision, while swap rates linked to policy meeting dates now show the US central bank benchmark ending 2023 around three quarters of a point below its new, post-decision level. Fed Chair Jerome Powell insisted Wednesday that rate cuts are not his “base case.”

The focus on banking stress was clearly evident from its prominent placement near the top of the monetary authority’s decision statement, which said that “recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity.” Powell also said during his press conference that the tightening of credit can substitute for policy hikes.

The impact on actual lending and credit provision from the current banking upheaval is, as yet, unclear. But given the disinflationary risk posed if there is a significant credit contraction, the outcome is likely to be a key determinant for how the Fed proceeds with its fight against inflation, even if official macroeconomic data continue to show resilience.

“Markets will shrug off stronger data over the near term because the tightening of credit hasn’t fully happened yet,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. Combined with “the lagged impact” from 475 basis points of rate hikes over the past year, “inflation should slow significantly later this year,” he said.

The rally in Treasuries gained additional support from comments by Powell that officials had actually considered a pause in rate hikes in the wake of recent banking problems before proceeding with the increase. The three-year Treasury rate fell 9 basis points Thursday to 3.63% having dropped 26 on Wednesday.

The Fed, as the institution responsible for backstopping the banking system, of course made a point of saying that it sees the banking system as “sound and resilient.” But the fact that it needs to mention it so prominently in its monetary policy statement does underscore the risks surrounding it.

Swap pricing now shows traders see the Fed doing, at most, one more quarter-point hike in May — although even that may be unlikely — before pivoting to a path of lower policy rates as economic pain begins to weigh. That’s a dramatic turnaround from the situation just a few weeks ago, when hotter-than-anticipated inflation indicators had some talking about the benchmark going as high as 6% even.

For its part, the Fed has largely maintained its economic forecasts, with the so-called dot plot of policymaker projections continuing to indicate a peak of around 5.1% for 2023. But the very lack of change in that dot plot also, perhaps, speaks to the difficulty of making any kind of solid forecast while the financial system is in such flux. Unable to either upgrade or downgrade their view, they instead remain pretty much rooted to the spot.

Assessing the extent of any credit crunch that might be rippling through the economy will take time to play out. And while it does, the bond market may well choose to cast a skeptical eye over reports that it’s ordinarily very clued in to. With risks overhanging, evidence of a still tight labor market and elevated inflation could be seen as backward looking indicators. And numbers that might ordinarily fuel higher yields could receive a more muted response.

“Instead of a Fed determined to keep battling inflation while putting out financial sector fires with liquidity provisions, we got a more conciliatory tone that suggested the path of rates would be more responsive to banking woes,” RBC Capital Markets Strategists Blake Gwinn and Izaac Brook said in a note to clients.

The importance of financial conditions was evident in the market’s reaction to Powell’s comments, with bond pricing appearing to be particularly responsive to references by the Fed chair to tighter credit and its linkage to policy rates.

“Credit conditions are playing a bigger role because of what has happened,” said Brandon Swensen, senior portfolio manager at BlueBay, a unit of RBC Global Asset Management. “During the press conference Powell mentioned that financial conditions would be tighter, with the question being one of how much tighter.”

The renewed drop in front end yields also triggered a steepening of the yield curve, the type of reaction that tends to gain momentum as the Fed prepares to pause a hiking cycle and eventually cut rates. On Wednesday, the 5-year yield flipped from trading a little above the 30-year to end the day 14 basis points lower than the long bond, while the inversion of the widely watched 2-to-10 year curve became markedly shallower. The steepening move extended on Thursday.

“Assuming this is the beginning of the Fed pivot, it will also mark the commencement of the cyclical resteepening of yield curve,” said Ian Lyngen, head of US rates strategy at BMO Capital Markets, noting that the gap between 5- and 30-year rates “is leading the charge of curve normalization.”

Of course anticipating a Fed pivot has been a trade that has burned bond traders on more than one occasion since June. Already this year, the bond market rallied in early January on recession fears, only to reverse as macro data surprised to the upside in February. That shift, along with hawkish commentary from Powell, saw traders send the two-year yield to a peak of 5.08% earlier this month, a move that has since reversed sharply.

“Time will tell whether the market is getting ahead of itself,” said Bluebay’s Swensen. While he doubts that the Fed will be cutting any time soon, those who are betting on that will be vindicated should tighter credit increase the odds of a recession. “The market is seeing something a different to the Fed,” he said.

--With assistance from Edward Bolingbroke.

(Updates pricing.)

©2023 Bloomberg L.P.