Dec 20, 2022

Credit Suisse Near Fresh Lows as Analysts Flag Credibility Hit

, Bloomberg News

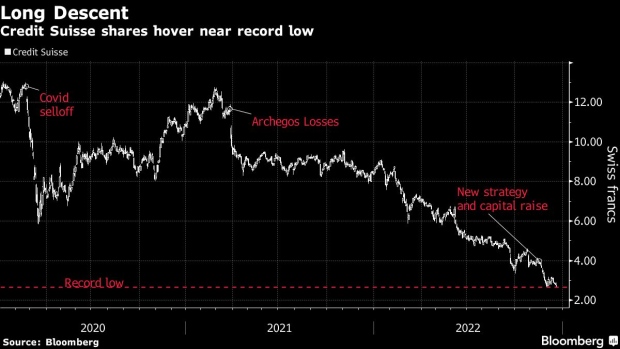

(Bloomberg) -- Credit Suisse Group AG shares are hovering near record lows as some analysts question the lender’s credibility due to a lack of visibility on its ambitious turnaround plan.

The stock slipped as much as 3.9% on Tuesday, declining for a seventh straight session, after Citigroup Inc., alongside RBC Capital Markets LLC, flagged future uncertainties. The banks’ sell-side analysts were resuming research coverage, having been a part of a syndicate that helped Credit Suisse drum-up its rights offering last month.

Citi’s Andrew Coombs said in a note he has “little conviction” in the Swiss lender’s strategic plan, “based upon the current limited disclosure and recent company track-record.” He expects Credit Suisse to make “a heavy loss” in 2023 on restructuring charges, before a return to breakeven in 2024.

RBC’s Anke Reingen, meanwhile, expects 2023 and 2024 to be years of “transition.”

Credit Suisse is undergoing a sweeping shake-up in operations that will see its investment bank carved up and greater focus placed on private banking after years of scandals and management missteps. However, the stock has been roiled by questions over the length of the lender’s rebuilding process as well as when the company will start seeing profits again.

Coombs resumed coverage of the stock with a buy/high risk recommendation, while RBC’s Reingen gave it a sector perform rating. Coombs said his preference is for peers, including UBS Group AG and Julius Baer Group Ltd. in Switzerland.

©2022 Bloomberg L.P.