Jan 10, 2024

Cytokinetics Deal Rumors Take Traders on White-Knuckle Ride

, Bloomberg News

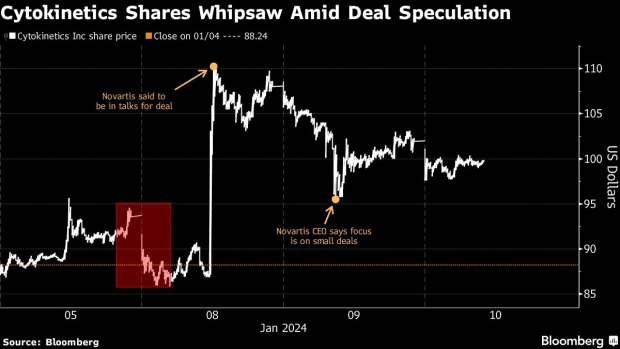

(Bloomberg) -- Traders expecting to make good on Cytokinetics Inc. takeover bets found themselves on a white-knuckle ride as prospects for a deal whipsawed shares.

Cytokinetics was already a takeover favorite when a batch of positive trial data hit in December. In the weeks that followed, shares soared nearly 200% amid multiple reports of buyer interest. But when a key meeting — the JPMorgan Healthcare Conference, a mecca for deals — opened with a flurry of transactions but no bid for Cytokinetics, shares started to fade only to be reignited by new rumors before hopes were dashed again.

Read more: Biotech Deal Surge Dials Up Buzz at JPMorgan Health Conference

The swings in Cytokinetics shows just how much is at stake for biotech investors. The recent revival in M&A for the battered sector has left holders struggling to assess the probability of a takeover and potential premiums should deals emerge for their preferred targets.

“It’s, to some degree, a little bit of game theory and we’re really now in more of an observation mode,” said Jared Holz, a strategist at Mizuho Securities.

Novartis AG and AstraZeneca Plc are some of the pharmaceutical companies reported to be considering a buyout of Cytokinetics. On Monday, investors started dumping shares of the South San Francisco-based company until a report of advanced deal talks with Novartis emerged and pushed the stock to a record high with a 15% gain, recouping an early drop.

Come Tuesday, when Novartis Chief Executive Officer Vasant Narasimhan said his firm is focusing on small merger deals below $5 billion, Cytokinetics — which has a market value closer to $10 billion — sank, ending the day with 5.6% drop.

Cytokinetics is facing even more choppy days ahead if a deal is not reached by the end of the week, according to B Riley Securities analyst Mayank Mamtani. He is skeptical that a merger announcement is imminent.

“The stock volatility is hard to predict,” Mamtani said. “It could go down first and then it could create an entry point.”

Mamtani, who raised his price target earlier this month to a Street-high of $122, still sees about 11 bidders that could take an interest in Cytokinetics.

Amid all the drama, options volume in Cytokinetics jumped this week, hitting an all-time high on Tuesday, according to data compiled by Bloomberg. Investors paid up for downside protection in the form of puts. The price of 10% out-of-the-money puts expiring in a month relative to calls rose to its highest level since late November.

Read more: Trader’s Quick Trigger on Biotech Bet Leaves $5 Million on Table

Possible buyers are largely competing for Cytokinetics’ lead drug, Aficamten, which offers a potential treatment for a heart condition known as hypertrophic cardiomyopathy.

If approved by US regulators, it would be the company’s first commercial product and the drug would compete with Bristol Myers Squibb Co.’s Camzyos, which was cleared in 2021 as a treatment for obstructive hypertrophic cardiomyopathy. Bristol bought Camzyos with the $13 billion acquisition of MyoKardia Inc. in 2020.

Mizuho’s Holz sees Cytokinetics looking for a similar, or better valuation than MyoKardia. Johnson & Johnson, Merck & Co and Amgen Inc are other potential buyers that could emerge, he added.

But with Cytokinetics valued at nearly $10 billion, Holz questions how much more upside there would be for investors from a takeout. Investors that owned the stock prior to the December trial readout are probably best off taking profits at these levels, he said.

“A triple based on where the stock was trading just two months ago is a home run,” Holz said. “You’re just looking to get the cherry on top at this point, but you’ve already got the sundae.”

--With assistance from Carly Wanna.

(Updates to add details on option expiry in 10th paragraph.)

©2024 Bloomberg L.P.