Jul 28, 2020

Czechs Pledge Finance for $7 Billion Nuclear Plant for Green Goal

, Bloomberg News

(Bloomberg) --

The Czech Republic moved closer to building another nuclear reactor by pledging financial support for a project it considers key to meeting its climate goals.

The government signed a deal with utility CEZ AS on Tuesday, in which it agrees to pay a fixed price for electricity from the planned new unit at the aging Dukovany atomic plant. The state has also pledged to provide a cheap loan to CEZ that will be interest-free for the duration of the construction between 2029 and 2036.

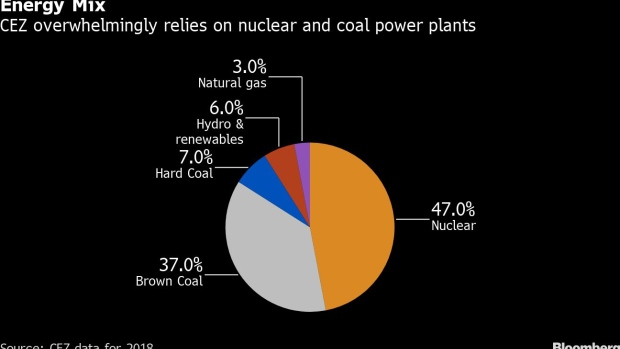

While nuclear power has for years been the cornerstone of the country’s plans to curb carbon emissions and boost its energy independence, this is the first time the state has offered financial help. The plan depends on securing a European Union endorsement for the state aid. If approval is granted, the 70% state-owned CEZ says the new 1,200 MW unit will be profitable.

“The Czech Republic doesn’t have any other path than the nuclear path toward non-emission sources,” Industry Minister Karel Havlicek said after signing the agreement with CEZ Chief Executive Officer Daniel Benes. “Renewable sources alone won’t be able to cover our needs.”

The guaranteed price will be established after CEZ and the government select the supplier of the reactor by 2022. The cabinet has estimated the price could be around 50 to 60 euros per megawatt-hour, which compares with the average market price of 37 euros over the past five years.

Last week, analysts at J&T Banka AS recommended buying the stock of the biggest traded power producer in eastern Europe, saying it could rally about 50% in a year. They said the preliminary agreement with the state largely removed investors’ earlier concern about the project’s profitability.

Still, the shares keep underperforming amid concern about risks to profits and dividends. The government has agreed to shield CEZ from low electricity prices and regulatory risks, but the utility would have to shoulder cost overruns that are typical for nuclear investments worldwide.

Government and CEZ officials estimate the expenditure at about $7 billion, or more than half of the company’s entire market capitalization. Critics of the plan, including some minority owners, say the facility is almost certain to cost more, based on the experience of other operators of atomic stations, such as Electricite de France SA.

The stock traded 0.2% down at 461.50 koruna on Tuesday, the lowest level since early May. Its 12% decline over the past year compares with a 10% gain for the Stoxx Europe 600 Utilities Index.

(Updates with signing of agreement in second paragraph.)

©2020 Bloomberg L.P.