Mar 29, 2023

Czechs to Hold Rates With Focus on Path to Cuts: Decision Guide

, Bloomberg News

(Bloomberg) -- The Czech central bank sought to correct investors’ expectations about when it may start easing monetary policy, calling bets on summer rate cuts “premature.” The koruna gained.

The bank held the benchmark rate at 7% on Wednesday, where it has been since new leadership halted rapid hikes last summer. Policy makers also maintained a commitment to prevent major currency swings, which has helped the koruna outperform its regional peers in the past year.

The Czechs were among the frontrunners in monetary tightening during the coronavirus pandemic, and investors now expect them to be one of the first to reverse the course after the worst cost-of-living crisis in three decades subsides. Central bankers are weighing weakening household consumption and cooling property prices against a tight labor market that’s still fueling wage growth.

Governor Ales Michl said policy makers will continue to discuss whether to keep borrowing costs stable or raise them, saying the board “is still prepared” to tighten policy further if salaries jump too much and threaten to create a wage-price spiral.

“From this point of view, market expectations that rates have already reached their peak may not materialize,” he told reporters in Prague. “Also, we consider market expectations about the timing of the first rate reduction as premature.”

The koruna strengthened as much as 0.4% against the euro after Michl’s comments, extending this year’s gains to 2.5%. A strong currency is helping tighten monetary conditions by lowering import prices and curbing the profitability of exporters that are increasingly using cheaper funding in euros.

“We welcome the strong koruna, it could be even stronger than it is now,” said Michl

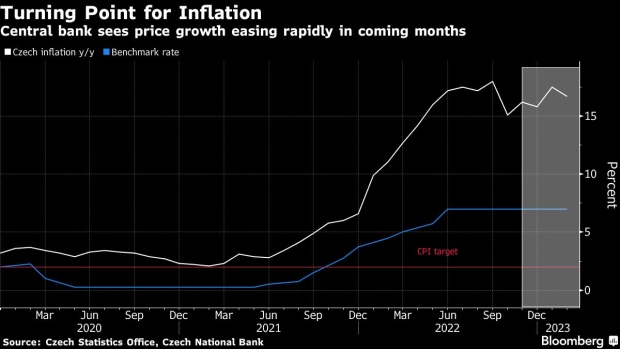

Czech inflation eased in February, to 16.7%, and the central bank expects it to slow to below 10% in the second half of the year. The bank’s latest projection sees price growth retreating to the 2% target by the middle of next year.

Money-market prices still show expectations that borrowing costs won’t rise further, but investors trimmed wagers on this year’s policy easing to about 100 basis points of cuts.

Since the central bank’s leadership overhaul, a majority of board members has preferred to smooth out the interest rate path instead of following staff forecasts implying more sharp rate hikes and then rapid cuts just months later. Still, one board member sought a 25 basis point rate hike on Wednesday.

“We see the message of the press conference as rather hawkish,” said Jaromir Gec, a strategist at Komercni Banka AS in Prague. “Michl’s pushback against market pricing of rate cuts is probably designed to support the koruna and address some of the persistent inflationary risks.”

(Writes through with governor’s comments starting in first paragraph.)

©2023 Bloomberg L.P.