Jun 9, 2023

Das Needs Monsoon Rains to Deliver Before Weighing Rate Cuts

, Bloomberg News

(Bloomberg) -- As Reserve Bank of India Governor Shaktikanta Das made the case for inflation risks arising from a delayed monsoon after holding interest rates again, the weather office declared the rains had finally reached the South Asian nation.

The weather announcement on Thursday provided some relief to the rate-setters and millions of farmers across India, but the concerns are not quite over. If there’s an uneven spread of the monsoon rains, Indian economy watchers say it may mean a longer wait for Das and his policy makers to cut rates and change the RBI’s tightening stance to neutral.

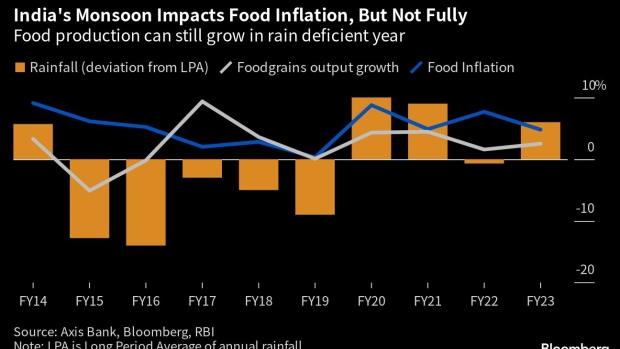

If rains are below normal, there will be higher retail food inflation readings than the 3.84% increase in April due to lower output, said Garima Kapoor, an economist at Elara Capital Plc. “So long as the spatial and inter-temporal distribution is good in key sowing month of July 2023, it may still not cause a significant damage,” she added in reference to rain patterns.

ANZ Group doesn’t expect a change in RBI’s policy stance at least until August when the impact of the monsoon will be clearer, while Goldman Sachs Group Inc. sees upside risks to food inflation due to uncertainties over the monsoon, potentially leading to rates on hold for the rest of the year.

India’s southwest monsoon, which waters about half of India’s farmlands, typically hits coastal Kerala on June 1. It reached the southern state on Thursday after the longest delay since 2019 while the meteorological office is forecasting a normal rainfall this year.

While headline numbers sometimes suggest a normal monsoon, it’s uneven distribution can be devastating, leading to crop failures. For instance, sugar millers cut their production estimates in April partly due to uneven spread of rains.

The monsoon rains are so crucial for Asia’s third largest economy that a former president once called it India’s “real finance minister.” The agriculture sector employs around half of the country’s workforce and their livelihood could be at risk as climate change increases flood and drought events.

While the RBI also assumed normal rains in its forecasts for a 5.1% inflation and 6.5% growth this year, monsoon-related uncertainties featured prominently in its commentary. Das mentioned it six times during his 35-minute policy speech on Thursday and went on to talk about it more with his rate setters in a media briefing later in the day.

“Close and continued vigil on the evolving inflation outlook is absolutely necessary, especially as the monsoon outlook and the impact of El Nino remain uncertain,” Das said. While inflation has eased to 4.7% after staying above RBI’s tolerance band for most of last year, he said it should fall further to the 4% midpoint on a “durable basis.”

Consumer price data due on Monday is likely to show retail inflation moderated further to 4.4% in May, according to a Bloomberg survey of economists as of Friday. Food inflation makes up nearly half of the CPI basket.

“There’s no sign yet of actual prices coming off from despite a clear indication of inputs costs dropping,” said Pankaj Pathak, portfolio manager at Quantum Asset Management Co. Pvt. “With the El Nino effect lurking around the corner and the recent decision of the Saudis to cut oil production potentially pushing up crude prices, there is less certainty about the disinflationary trajectory.”

What Our Economist Says...

“We see rate cuts happening only if upside risks to inflation don’t play out. If rains disappoint then depending on how much of an impact that has on inflation, further rate hikes can’t also be ruled out entirely”

— Abhishek Gupta, Bloomberg Economics

For a full note, click here.

Below-normal rains in India often prompts the government to start work on drought-relief and take steps to prevent a spike in food prices by restricting exports of agricultural commodities and ramping up imports of edible oils. Saugata Bhattacharya, an economist with Axis Bank, said such measures would help with food prices rather than just relying on monetary policy.

India’s monsoon season, that accounts for 75% of the annual rainfall, runs from June to September. By the next review in August, the monetary policy committee will have more details on the progress and spread of the rainfall.

It’s looking like mixed fortunes for now. India’s weather office and some global models have predicted a high probability of El Nino developing during the monsoon season. This may be offset by the likelihood of positive Indian Ocean dipole conditions that bring about greater rainfalls but even this is not certain.

El Nino, associated with drier conditions and reduced rainfall, can push farmers to delay the timely sowing of crops such as rice, corn and soybeans. The weather condition has historically led to deficient rainfall in India, adversely affecting agricultural output and driving up food prices, said Alexandra Hermann, an economist at Oxford Economics.

“What’s more, a bad harvest would dent rural incomes, thus reducing domestic consumption demand,” she said.

--With assistance from Pratik Parija and Jas Bardia.

(Updates with comments)

©2023 Bloomberg L.P.