Jan 11, 2024

Deutsche Bank Sees Strong Dollar Even as Fed Cuts Interest Rates

, Bloomberg News

(Bloomberg) -- The dollar is set to strengthen as the resilience of the US economy allows Federal Reserve officials to cut interest rates slower than other major central banks.

That’s the view, at least, of George Saravelos, Deutsche Bank AG’s global head of foreign-exchange research, who expects the greenback to end 2024 as one of the world’s top-three high yielders. Growth and inflation indicators in Group-of-10 nations show the euro area and Sweden are most likely to require more-rapid dovish policy pivots, Saravelos wrote.

“The US exhibits no such urgency,” he wrote in a Thursday note. “The Fed is priced to be the most dovish central bank over the next two years given the higher starting point of rates, but there are reasons to doubt this will materialize as soon as is priced.”

The US economy has flashed resilience in the face of the Fed’s most-aggressive rate-hiking campaign in decades, with inflation accelerating at the end of 2023. That’s challenging the views of some on Wall Street who’d expected the Fed to begin reducing interest rates as soon as March.

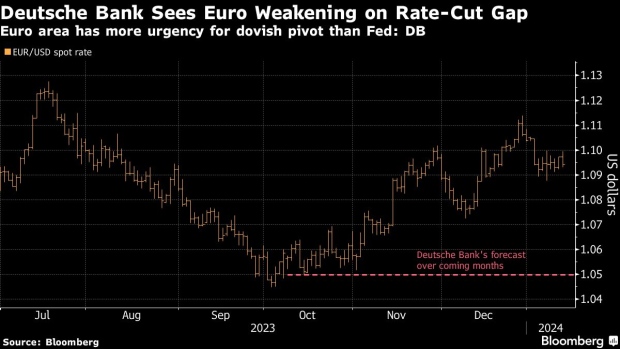

Deutsche Bank strategists expect the euro to weaken to $1.05 in the first few months of this year, implying a roughly 4% drop from the current level. They also like buying the dollar against the yen as the Japanese currency is set to weaken to 150 against the greenback in the coming months.

To Saravelos, the dollar is also supported by lingering uncertainty surrounding major global elections — namely, the presidential showdown looming in the US. The candidates should be known by March and, in contrast to 2016, the prospect of a former President Donald Trump victory is likely to be priced in ahead of time, he wrote.

“The market is most likely to focus on Trump’s foreign policy and trade priorities which include a 10% across-the-board tariff on imports,” he wrote. “Such a policy is likely to be materially positive for the dollar and with very little priced in the risks.”

In a separate note to clients, Deutsche Bank strategist Alan Ruskin wrote that a scenario in which the republican party takes control of both the presidency and congress has historically led to a deterioration of the US fiscal accounts and weaker current account position. In that case, the dollar typically weakens.

While neither Trump nor incumbent President Joe Biden have demonstrated an appetite for long-term fiscal consolidation, it appears Biden would be marginally more positive for the dollar thanks to a likely more-mainstream Treasury Secretary pick, Ruskin wrote.

©2024 Bloomberg L.P.