Apr 28, 2021

Discovery shares fall as streaming, ad sales disappoint

, Bloomberg News

The channels business will be here to stay for a long time: Corus Entertainment CEO

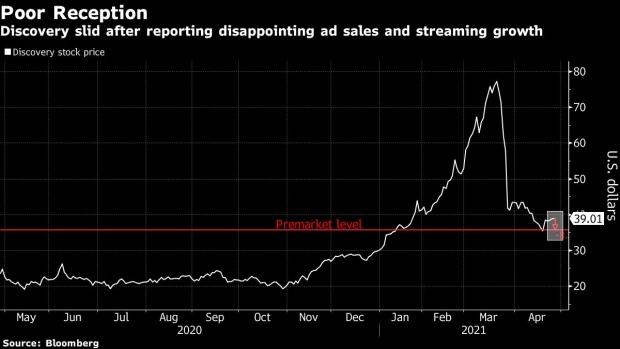

Discovery Inc., the owner of cable channels such as HGTV, TLC and Animal Planet, tumbled after reporting streaming subscribers and advertising sales that disappointed investors.

Discovery launched Discovery+ on Jan. 4, betting that unscripted shows about romance, food and home improvement would stand out in a crowded market for streaming services. Total subscribers to all of the company’s streaming outlets stand at 15 million, Discovery said Wednesday, having crossed 13 million at the end of the first quarter.

That’s up from 5.2 million in December, before the U.S. launch of Discovery+, and about 12 million in February. But investors hoped for more, conditioned to torrid growth from the likes of Walt Disney Co.’s Disney+.

Discovery doesn’t disclose subscribers specifically for Discovery+ but has said they’re the majority of the company’s direct-to-consumer customers. The company has smaller streaming services targeting areas such as golf and cooking.

Elsewhere, Discovery’s U.S. advertising sales fell 4 per cent in the first quarter, with the company citing lower ratings “and to a lesser extent secular declines in the pay-TV ecosystem and lower inventory.”

Discovery shares fell as much as 8.8 per cent to US$35.56 in New York trading Wednesday. The stock remains up about 55 per cent for the past year despite wild fluctuations: It rose sharply at the start of 2021, then shed nearly half its market value after the investment firm Archegos Capital Management was forced to liquidate its equity positions.

Geetha Ranganathan, an analyst with Bloomberg Intelligence, cited “very weak advertising and Discovery+ sub growth slowing” as driving the stock declines Wednesday.

Taking a rosier view, Wells Fargo analysts led by Steven Cahall said in a note that Discovery’s 15 million in total streaming subscribers are close to the firm’s estimate of 16 million for the second quarter. “We’d say the sub performance is in line to ahead of expectations,” they wrote.

Earnings of 21 cents a share missed analysts’ consensus expectation of 63 cents. Revenue of US$2.79 billion was about in line with Wall Street’s estimates of US$2.78 billion.

--With assistance from Katrina Lewis.