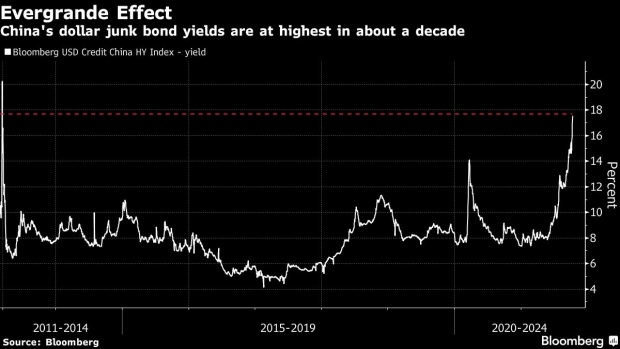

(Bloomberg) -- China Evergrande Group’s debt crisis shows no signs of easing, with some holders of its dollar bonds with payments due Monday saying they had yet to receive them during Asian business hours.

The investors said they hadn’t received the coupons on the firm’s 9.5% note due 2022 and its 10% bonds due 2023 as of 5 p.m. in Hong Kong. There is a 30-day grace period before any missed payment would constitute a default. Evergrande also missed initial coupon deadlines for two other offshore bonds last month.

In the latest indication that financial stress in China’s real estate sector is moving beyond Evergrande, Shanghai-based developer Sinic Holdings Group Co. said it doesn’t expect to pay the principal or interest due Oct. 18 for a $250 million bond, adding that a default will likely occur.

Moody’s Investors Service has downgraded Modern Land (China) Co.’s credit rating to Caa2 from B2. and placed the company’s ratings on review for further downgrade. The ratings firm said the move follows the developer’s proposal to seek a three-month extension on a dollar bond due Oct. 25, a sign of its “rapidly deteriorating liquidity.”

Key Developments:

- Some Evergrande Bondholders Haven’t Received Coupons Due Oct. 11

- Sinic Likely to Default on 2021 Bonds, Trigger Cross Defaults

- Greenland Says Pre-Sale Permits Back to Normal in China Jinan

- Michael Pettis on What Evergrande Means for China’s Macro Economy

Sinic Likely to Default on 2021 Bonds, Trigger Cross Defaults (7:50 a.m. HK)

Sinic Holdings Group Co. does not expect to make payments of the principal and last installment of interest due Oct. 18 for a $250 million bond issue, and that an event of default will likely occur, the Chinese real estate developer said in a Hong Kong stock exchange filing.

Greenland Says Pre-Sale Permits Back to Normal in China Jinan (7: 45 a.m. HK)

Greenland Holdings Corp. said pre-sale permits for its property projects in the eastern Chinese city of Jinan are back to normal after the company corrected mistakes at some projects as required by the local government.

The Shanghai-based developer issued a statement after the Economic Observer reported that Jinan authorities halted the firm’s permits due to recent delays in home deliveries.

Some Evergrande Bondholders Haven’t Received Coupons Due Oct. 11 (10:10 p.m. HK)

Investors said they hadn’t received coupon payments on the Evergrande’s 9.5% note due 2022 and its 10% bonds due 2023 as of 5 p.m. in Hong Kong. Together with the payment due on a third bond -- a 10.5% note due 2024 -- Evergrande’s combined interest due on Monday was about $148 million, according to data compiled by Bloomberg.

Evergrande dollar bond interest deadlines:

©2021 Bloomberg L.P.