May 15, 2022

Dollar Edges Higher Early Monday Amid Growth Risks, NATO News

, Bloomberg News

(Bloomberg) -- The dollar appears poised to extend its run of strength, with the US currency quoted slightly higher against a number of its major peers in early Asia-Pacific trading on Monday.

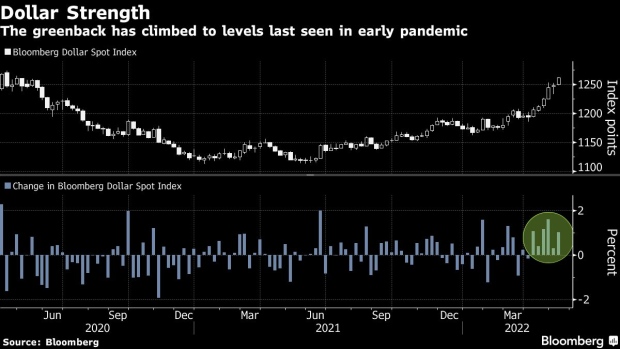

The greenback, which often acts as a haven in times of concern, was quoted slightly higher against the pound and euro and was within tight ranges versus other major currencies. The Bloomberg dollar index, which measures the currency against a basket of key counterparts has climbed for the past six weeks and on Thursday touched its strongest level since the first half of 2020, when the global economy was reeling from the onset of the Covid pandemic.

The latest moves follow a brutal week for global stock markets and come amid increasing concern among investors about the prospects for growth in major economies. Goldman Sachs Group Inc. is among the latest to issue fresh warnings, with the bank cutting its US growth forecasts and Senior Chairman Lloyd Blankfein saying that a recession in the world’s biggest economy is a “very, very high risk.”

Geopolitical concerns in Europe related to the Russia-Ukraine war are likely to remain at the forefront of investor thinking, with moves by Finland and Sweden toward joining the North Atlantic Treaty Organization potentially amplifying tensions.

The euro was quoted down 0.1% at around $1.0398, while the pound slid 0.2% to $1.2241. The US-Canadian pair was little changed around 1.2925, while the Norwegian, Swedish and Australian currencies were all quoted a bit weaker. Foreign-exchange markets are among the first to open globally, before trading in bonds, stocks and other related assets gets underway.

©2022 Bloomberg L.P.