Apr 12, 2024

Dollar Eyes Best Run in 18 Months on Fed Rethink, Haven Demand

, Bloomberg News

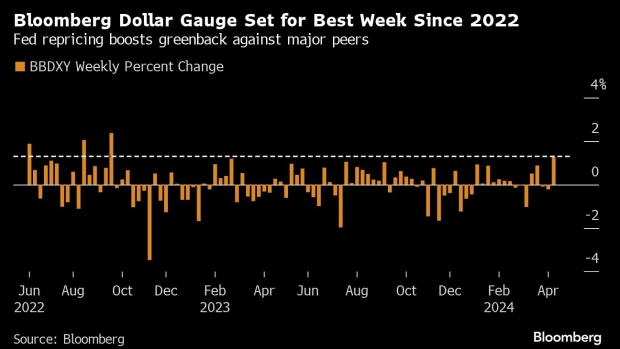

(Bloomberg) -- The strength of the US economy and the relative safety of the world’s most traded currency helped push the dollar to its biggest weekly gain in more than a year and a half.

The greenback sharply advanced alongside Treasuries Friday after a report that Israel is preparing for an imminent Iranian attack. The currency’s safe-haven status and hotter-than-expected inflation data sent a Bloomberg gauge of the dollar up more than 1.4% from Monday’s open to its close Friday — the largest weekly advance since September 2022.

Underpinning the latest bout of dollar strength was a key reading of US consumer price growth that topped estimates Wednesday, leading swaps traders to rein in expectations for a near-term policy shift and price around two rate cuts this year from the Federal Reserve beginning around September. Prospects for US policy are increasingly diverging from other, global monetary authorities like the European Central Bank, which signaled this week a rate cut could come as soon as June amid softening inflation reports.

“Looking at the indicators — at least for the time being — there could be some argument for continued dollar strength,” said Alejandra Grindal, Ned Davis Research’s chief economist. “Based on what we know now, there seems to be an increasing possibility that the Fed won’t go first.” The dollar, historically, has strengthened when other major central banks have moved first, she noted.

Investors are consequently piling into trades tied to bets that the dollar will rise and added to those bullish positions in the week leading up to the CPI release Wednesday.

Asset managers, hedge funds and other speculative market players are now the most positive on the greenback since the fall of 2022 as measured in dollars, according to the latest Commodity Futures Trading Commission data through April 9th as aggregated by Bloomberg. The net long exposure among these non-commercial traders now totals around $17.5 billion, the CFTC data released Friday showed.

Read more: Traders See Fed Waiting Until After Summer to Cut as Yields Soar

On Friday, the euro fell to its lowest mark against the dollar since last November, reigniting discussions of whether the common currency might reach parity versus the greenback.

Risk-sensitive currencies like the Swedish krona and Australian dollar also each fell more than 1%. The Japanese currency — also a safety play — was one of the the few Group-of-10 or emerging market currencies to hold up against the greenback Friday and was on pace to end the session little changed.

“With the Fed in a comfortable position to stay on hold, compared to other economies where growth is poorer, we could see more bouts of US dollar strength, especially vs European currencies,” said Dominic Schnider, head of global foreign-exchange and commodities at UBS Global Wealth Management.

Read more: ECB-Fed Split Sends Euro to Five-Month Low as Parity Talk Grows

--With assistance from Nazmul Ahasan.

(Updates to include BBDXY close, latest CFTC positioning data.)

©2024 Bloomberg L.P.