Jul 19, 2022

ECB Is Looking More Closely at a Half-Point Hike This Week

, Bloomberg News

(Bloomberg) -- The European Central Bank may consider raising interest rates on Thursday by double the quarter-point it outlined just last month because of the worsening inflation backdrop, according to people familiar with the situation.

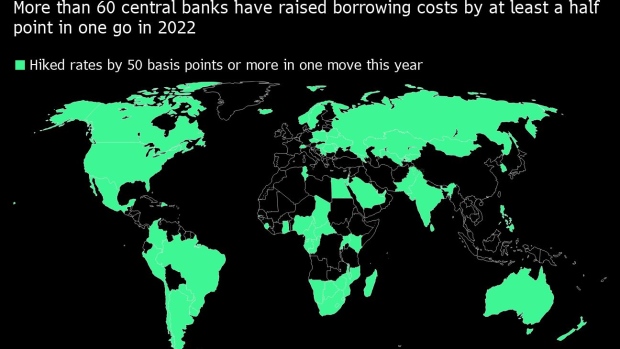

Such a move would mark a sharp deviation from guidance that the majority of Governing Council members have stuck to since it was laid out at the June 9 policy meeting and would bring the ECB more in line with the global drive for outsized hikes.

As officials lift rates this week for the first time in more than a decade, it’s unclear whether there’ll be sufficient support for a 50 basis-point increase, the people stressed, who asked not to be named discussing private deliberations. Chief Economist Philip Lane will make the official policy proposal at the meeting.

But President Christine Lagarde left space to go beyond 25 basis points in a June 28 speech, days before data showed euro-zone inflation surged more than expected to a new all-time high of 8.6% -- more than four times the 2% target.

“There are clearly conditions in which gradualism would not be appropriate,” she said. “If, for example, we were to see higher inflation threatening to de-anchor inflation expectations, or signs of a more permanent loss of economic potential that limits resource availability, we would need to withdraw accommodation more promptly to stamp out the risk of a self-fulfilling spiral.”

The majority of economists predict the ECB will hike by 25 basis points this week, with just four of 53 in a Bloomberg survey predicting a half-point increase.

Money markets raised wagers on the pace of tightening on Tuesday, betting on almost 40% odds of a half-point hike this week and more than a percentage point by September.

“We do not rule out a 50 basis point rate hike at this week’s meeting,” Matthew Ryan, Head of Market Strategy at Ebury, said before the latest deliberations were reported. “We have already seen most major central banks deliver bumper rate increases in recent weeks in an attempt to control rampant price growth -- there is even talk that the FOMC may consider a one percentage point move later this month.”

Governing Council members who have publicly floated a bigger move this month include Austria’s Robert Holzmann, Latvia’s Martins Kazaks and Lithuania’s Gediminas Simkus.

(Updates with markets in sixth paragraph)

©2022 Bloomberg L.P.