Mar 6, 2023

ECB’s Holzmann Wants Four More Half-Point Rate Hikes

, Bloomberg News

(Bloomberg) -- European Central Bank Governing Council member Robert Holzmann said he backs half-point interest-rate hikes at every meeting through July, forcing two-year German bonds to reverse gains.

“I assume that core inflation will not weaken significantly in the first half of the year and will remain around the current level,” he told Handelsblatt in an interview published Monday. “In that case, I expect we’ll hike rates by half a percentage point four more times this year.”

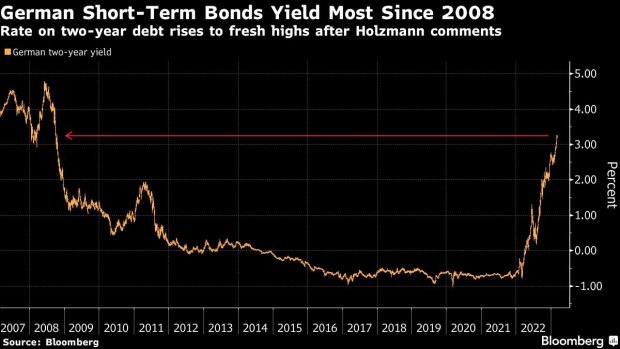

German two-year bonds reversed earlier gains on Holzmann’s comments, with the yield up five basis points at 3.26%, the highest since 2008. Traders added to rate-hike bets, pricing a peak in the ECB’s deposit rate of around 4.05%.

Holzmann, who heads Austria’s central bank, is among the ECB’s most hawkish rate setters. Officials are almost certain to raise borrowing costs by another half point next week, though what happens after that is less certain.

Chief Economist Philip Lane said earlier Monday that the ECB will probably have hike rates again after next week’s increase, though policymakers must tailor any action to incoming data.

Holzmann said the level of borrowing costs still isn’t restrictive and would need to be much higher to constrain economic growth.

“Even if we now raise interest rates three times by 0.5 percentage points, we are only at a deposit rate of 4%,” he said. “Only there would we roughly get into the restrictive area.”

Holzmann also said the ECB could consider adding further bonds to its quantitative-tightening program to shrink its balance sheet at a faster pace.

Winding down purchases from PEPP, the bond-buying program announced at the start of the pandemic, could be discussed in the autum, he said. That compares with the ECB’s pledge to keep reinvesting volumes until the end of 2024.

“I want to put that on the table, otherwise we risk losing another year,” Holzmann told HB. To shrink the balance sheet “to a reasonable level, we’ll probably have to be somewhat more aggressive,” he said.

(Adds bonds starting in first paragraph)

©2023 Bloomberg L.P.