Jun 5, 2023

ECB’s Lagarde Says Price Pressures Strong, Rate to Rise More

, Bloomberg News

(Bloomberg) -- European Central Bank President Christine Lagarde said inflation pressures remain powerful and borrowing costs will be raised further to tackle them — cementing expectations for another interest-rate hike at next week’s meeting.

With the full effects of the ECB’s already historic monetary-tightening campaign still materializing, Lagarde reiterated that there’s no clear evidence that underlying inflation has peaked. Food inflation, for one, remains elevated, she said Monday.

“Price pressures remain strong,” Lagarde told European Union lawmakers in Brussels.

“Our future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our 2% medium-term target and will be kept at those levels for as long as necessary, she said.

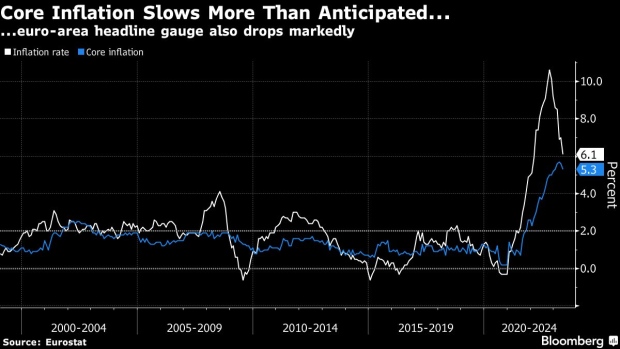

The remarks, while largely reiterating language many ECB officials have been using of late, indicate that the recent bout of rate increases isn’t done just yet. Despite May bringing a second straight slowdown in the gauge of core inflation that’s currently the focus of policymakers, most investors and analysts predict another hike on June 15.

Ireland’s Gabriel Makhlouf has said the ECB is likely to raise at both its June and July meetings — bringing the deposit rate to 3.75% from 3.25% now. Ignazio Visco, the more dovish head of Italy’s central bank, said at the weekend that “would have pushed for a more gradual approach” to hikes, which have totaled 375 basis points since last July.

Speaking separately on Monday, Bundesbank President Joachim Nagel once again suggested that rate increases may need to persist beyond July.

“As things stand, several interest-rate steps are still needed,” he said in a speech. “In my view, it is by no means certain that interest rates will reach their peak as early as this summer.”

Discussing euro-zone banks following the wider turbulence in that industry, Lagarde was optimistic.

“Financial stability in the euro area has proved robust so far, but we continue to assess possible risks, taking into account a wide range of indicators,” she said. “We do not see a trade-off between financial stability and price stability in the euro area.”

--With assistance from Bryce Baschuk.

(Bundesbank corrects translation in eighth paragraph of story published on June 5)

©2023 Bloomberg L.P.