Sep 15, 2021

ECB’s Lane to Investors: Don’t Focus on Bond-Buying Volumes

, Bloomberg News

(Bloomberg) -- European Central Bank Chief Economist Philip Lane said investors should look beyond the sheer volume of asset purchases in assessing the institution’s monetary policy, just days after officials decided to slow down buying in the fourth quarter.

Asked whether the subdued medium-term inflation outlook wouldn’t warrant an increase rather than a withdrawal of stimulus, Lane said that “it’s not a good idea to identify the monetary policy stance with the volume of asset purchases.”

“The efficient approach is to emphasize persistence,” he said in a webinar on Wednesday. “We’re happy that our monetary accommodation is strengthening the underlying inflation dynamic and over time -- this will continue to build. We have a coherent policy setting.”

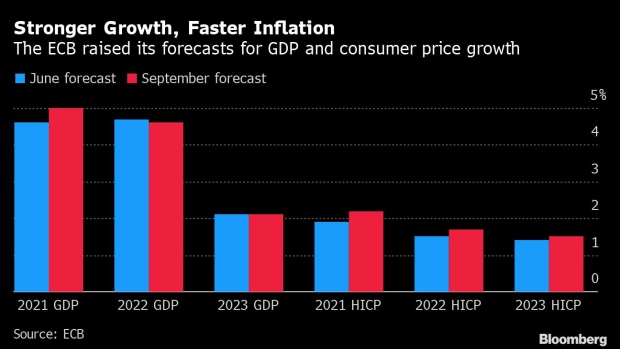

The ECB last week decided to “moderately lower” the pace of buying under its 1.85 trillion-euro ($2.2 trillion) pandemic program, a shift that President Christine Lagarde insisted shouldn’t be seen as a decision to wind-down stimulus. New projections meanwhile showed a current spike in inflation will probably be temporary, and that price growth will average 1.5% in 2023, well below the ECB’s 2% target.

©2021 Bloomberg L.P.