Apr 11, 2024

ECB to Hold With First Cut Locked In for June: Decision Guide

, Bloomberg News

(Bloomberg) -- The European Central Bank is set to keep borrowing costs on hold for a fifth meeting while further readying the ground for cuts to begin in June.

The deposit rate will be kept at a record-high 4% on Thursday, according to an almost unanimous poll of economists by Bloomberg. Just one of the 62 respondents predicts a quarter-point reduction.

While inflation has retreated to within sight of the 2% target, officials aren’t quite ready to start dialing back the unprecedented spate of rate hikes they enacted to tame prices. Officials right up to President Christine Lagarde have indicated that they’ll have more confidence — particularly over wage growth — by mid-year.

“The ECB has signaled that interest rates will very likely be cut in June and the latest inflation data should have reinforced this,” said Ulrich Kater, chief economist at DekaBank. “Beyond June, the uncertainty and the risks to the inflation outlook argue for caution and Lagarde may hold back with signals.”

With monetary loosening already underway in neighboring Switzerland, the debate in the 20-nation euro zone has turned to how quickly rates will be lowered after June. Policymakers such as Greece’s Yannis Stournaras favor another cut in July, while others prefer to pause — at least until the following meeting, in September.

Another factor is the US, where the Federal Reserve is navigating sticky inflation and robust economic growth. That’s making officials cautious about easing prematurely and raising the prospect the ECB moves first. While not an issue in itself, prolonged divergence could rattle currency markets and shift consumer prices again.

What Bloomberg Economics Says...

“With wage growth cooling, corporate profit margins in check and a headline inflation undershoot creeping into view, the ECB will soon cut rates. But since the cost of being caught out by a resurgence of inflation would be high (a U-turn would seriously undermine credibility), it’s understandable that the Governing Council is being cautious.”

—Jamie Rush, chief European economist. Click here for full preview

Lagarde will be quizzed about these and other issues when she addresses journalists at 2:45 p.m. in Frankfurt, 30 minutes after the ECB’s policy announcement.

- Follow the ECB TLIV blog here

Interest Rates

Expectations of a summer pivot by the ECB were stoked last week as an account of March’s policy meeting revealed that officials saw “the case for considering rate cuts was strengthening.” Thanks to “encouraging” progress on inflation, they also concluded that the date for a first move is “coming more clearly into view.”

Some refuse to rule out action this week, fretting about consumer-price growth dipping below 2% and the ECB falling behind the curve in removing the restriction on the economy.

But the majority backs June, by which point additional figures on inflation, wages, profits and productivity will be available. That timetable matches the views of economists and investors after markets slashed their rate-cut bets.

The subsequent pace of easing is less clear, with Lagarde saying in March that officials can’t commit to reductions beyond the first and emphasizing their “data-dependent” approach.

The account of the last meeting described market expectations at the time as “broadly in line with macroeconomic fundamentals.” On March 6, investors predicted about 90 basis points of cuts in 2024.

Economic Backdrop

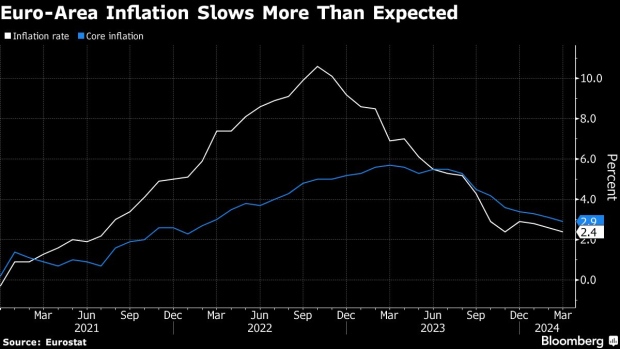

Euro-area inflation undershot last month, slowing to 2.4% from 2.6% in February. The core rate that excludes energy and food also moderated, to 2.9% from 3.1% — the lowest level since early 2022.

Some economists and policymakers see price gains easing to or even below 2% this summer — even as the ECB’s latest staff projections only see this happening in the latter half of 2025.

Rising services prices, however, are what economists at Allianz have called “the fly in the ointment for the ECB.” Indeed, they’re growing at 4%, while labor costs are also advancing in excess of historical averages, even after the pace of negotiated-wage increase moderated in late 2023.

The bloc’s economy, on the other hand, has been flirting with a recession for more than a year. While the ECB predicts a gradual, consumption-led recovery and green shoots are even starting to appear in Germany — currently the region’s biggest laggard — a recent survey of bank lending unearthed plunging corporate demand.

ECB Vs. Fed

While markets put the likelihood of the ECB cutting in June at about 80%, they see a less than 20% chance of a Fed move that month.

Officials in Frankfurt, who’ve diverged from their US counterparts in the past, have repeatedly stressed their independence. Finland’s Olli Rehn has said the ECB “isn’t the Fed’s ‘13th Federal District.’”

Read more: Traders Pare ECB Cut Bets After US CPI, All Eyes on Lagarde

A longer bout of loosening in Europe, though, without such action in the US would have implications, according to Mohamed El-Erian, the president of Queens’ College in Cambridge and a Bloomberg Opinion columnist.

The potential discrepancy between the pace of ECB and Fed easing “is having a huge impact on relative pricing between Europe and the US,” he said. “You do see that in the bond market, you see it in the currency market,” he said, adding that parity between the euro and the dollar “is a possibility.”

Traders on Thursday pared bets on ECB rate cuts in 2024 to less than 75 basis points for the first time in six months.

Operational Framework

Lagarde may also be asked about the ECB’s new operational framework that officials unveiled a week after last month’s policy meeting.

The setup preserves the current system of steering rates while giving banks more of a say over how much liquidity they need to operate. Longer-term lending operations and a structural bond portfolio are also envisaged in the future — with policymakers differing over the parameters.

Economists surveyed by Bloomberg expect these instruments to arrive in as little as 15 months — a lot sooner than officials anticipate.

--With assistance from Jana Randow, Greg Ritchie, Barbara Sladkowska and Joel Rinneby.

(Updates with rate-cut bets in 21st paragraph.)

©2024 Bloomberg L.P.