May 4, 2023

ECB Vows More Hiking to Come After Slowing Tightening Pace

, Bloomberg News

(Bloomberg) -- The European Central Bank delivered the smallest interest-rate increase yet in its battle with persistently strong inflation but insisted that the move won’t be the last.

Officials raised the deposit rate by a quarter-point to 3.25%, following three steps of double that size. The announcement matches the expectations of traders and most economists, leaving the rate at its highest level since 2008.

The Governing Council said future decisions will remain data-dependent as they bring rates to levels sufficiently restrictive to return inflation to the 2% target. They’ll be kept there for as long as necessary, it said.

“We have more ground to cover and we are not pausing,” President Christine Lagarde told a news conference. “That’s extremely clear.”

She described Thursday’s decision as “almost unanimous,” with some of her colleagues favoring a bigger hike. People familiar with the matter told Bloomberg that the policymakers pushing for a half-point move didn’t put up much of a fight even though several were in favor.

In what may be seen as a concession to hawkish officials, to win their backing for the smaller rate increase, the ECB also said it expects to halt reinvestments under its Asset Purchase Program as of July.

The ECB’s stash of bonds from both APP and the smaller Pandemic Emergency Purchase Program amounts to roughly €5 trillion ($5.5 trillion). While shrinking the APP portion by €15 billion a month from March didn’t cause any ruptures on financial markets, analysts polled by Bloomberg had only expected reductions to quicken more gradually.

Reinvestments under the separate PEPP initiative will continue as planned at least through 2024, according to Lagarde.

Money markets eased rate-hike wagers following the decision, betting that the deposit rate will peak by September.

What Bloomberg Economics Says...

“The downshift to 25 basis points, coupled with only a loose commitment to do more, signals an important shift in the policy outlook for the ECB. We expect the hiking cycle to end in June, assuming the inflation data allow it. A July hike remains a possibility.”

—Jamie Rush, chief European economist

With inflation well beneath its October peak and a gauge of underlying price pressures falling for the first time in 10 months, policymakers in Frankfurt are contemplating the end of their unprecedented period of monetary tightening. The job isn’t quite complete, though: Markets and analysts see two more steps of 25 basis points to come.

Such additional action would stand in contrast to the Federal Reserve, which on Wednesday raised rates for a 10th straight time but suggested it may pause its own hiking campaign as the financial sector faces a new wave of pressure.

Lagarde said “significant” upside risks to the inflation outlook remain.

“These include existing pipeline pressures that could send retail prices higher than expected in the near term,” she said. “Recent negotiated wage agreements have added to the upside risks to inflation, especially if profit margins remain high.”

- Follow the ECB TLIV blog here

As well as April’s readings of price gains, the runup to Thursday’s announcement saw data revealing slower-than-anticipated economic expansion in the 20-nation euro zone, alongside tighter credit conditions than banks had expected — further threatening growth.

Banking turbulence following Credit Suisse Group AG’s takeover by UBS Group AG may have exacerbated that trend. While officials say the continent’s financial system is sturdy, the fresh turbulence in the US comes as European lenders are scheduled to return almost €500 billion ($549 billion) in cheap long-term funding to the ECB next month.

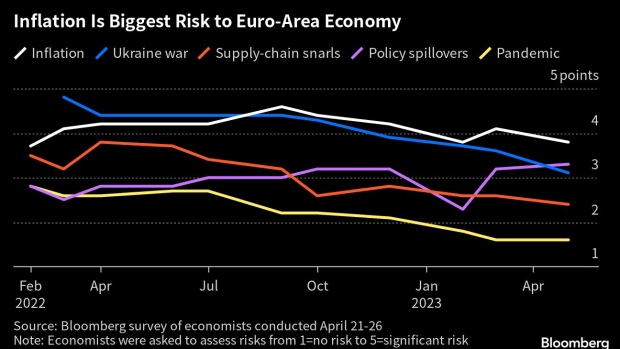

For now, though, inflation remains the top concern, with the 375 basis points of tightening since July 2022 still filtering through the economy and the goal for price growth some way off.

Policymakers have long been watching wage growth but are now also looking more closely at corporate profit margins, which have widened during the inflation shock and could sustain price pressures if a resilient labor market keeps underpinning demand.

Unemployment in the euro region hit an all-time low of 6.5% in March, data this week showed.

Executive Board member Isabel Schnabel, one of few officials to openly consider a more aggressive half-point hike, said in an interview published last week that “it’s far too early to declare victory on inflation.”

Colleagues including Francois Villeroy de Galhau struck a more modest tone. Future rate increases should be limited in size and number, given the ECB has completed most of the process, the Bank of France chief said last month.

Once rates reach their peak, the ECB hasn’t given specific guidance on how long they’ll stay there.

“I’m not here making any commitment to cut at any point in time,” Lagarde said.

--With assistance from Bryce Baschuk, James Regan, Marton Eder, Zoe Schneeweiss, Ben Sills, Christoph Rauwald, Phil Serafino, Barbara Sladkowska, Joel Rinneby, James Hirai, Jasmina Kuzmanovic, Alexander Pearson, Alexey Anishchuk, Andrea Dudik and Bastian Benrath.

(Updates with ECB hawks in fifth paragraph)

©2023 Bloomberg L.P.