Sep 22, 2022

Economists Raise RBA Cash Rate Outlook to 3.1% by Year’s End

, Bloomberg News

(Bloomberg) -- Economists raised their forecasts for Reserve Bank of Australia policy tightening as they boosted expectations for household spending amid a very tight labor market and elevated savings levels.

The RBA will raise its cash rate by a further 75 basis points over the final three months of this year to 3.1%, versus a previous 2.85%, according to the median estimate in a Bloomberg survey. Economists now see a peak of 3.35% in the first quarter after significantly upgrading consumption forecasts.

“We expect the RBA, under pressure from sticky annual inflation above 3% over the forecast period, to lift and keep the cash rate above 3%,” said Stephen Roberts at Laminar Capital. That will cause “a marked moderation in economic growth.”

Australia’s central bank is in the midst of its sharpest policy tightening cycle in a generation, having hiked by a half-percentage point at its past four meetings to take the cash rate to 2.35%. Governor Philip Lowe has signaled a potential step down in the size of rate rises ahead, though a number of economists only expect that shift to occur in November.

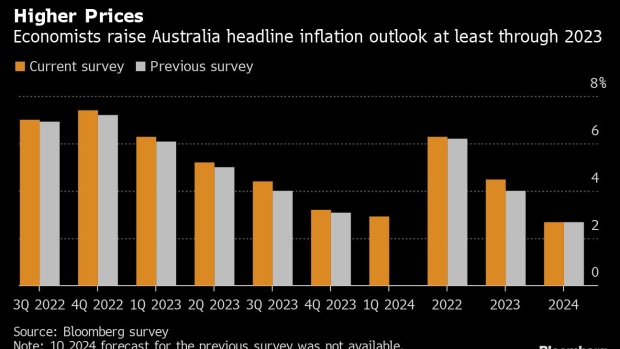

The statistics bureau will release third-quarter inflation data on Oct. 26 that’s expected to show a further acceleration in prices, with the RBA forecasting a peak of just under 8% late this year. Economists also upgraded their inflation forecast to 7.4% in the final three months of the year.

“Higher growth means higher inflation for longer,” said Josh Williamson, chief economist for Australia and New Zealand at Citibank Inc. “Underlying inflation is expected to remain outside the RBA’s 2%-3% target band throughout 2023.”

©2022 Bloomberg L.P.