Sep 12, 2023

Egypt’s Soaring Cigarette Prices Cast Smokescreen Over Inflation Outlook

, Bloomberg News

(Bloomberg) -- For a sense of Egypt’s inflation and currency woes, look no further than the line of customers at a Cairo kiosk jostling for a pack of smokes.

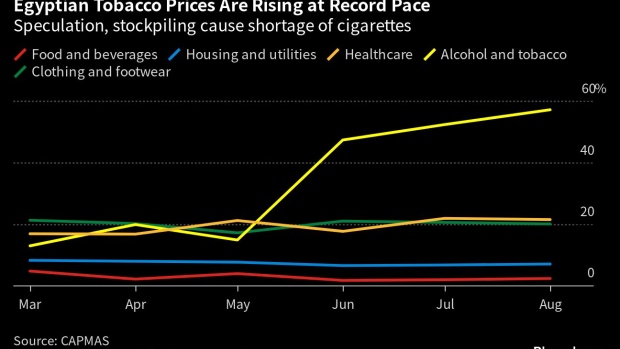

In a country of 18 million smokers, speculation about imminent price hikes has led traders to stockpile cigarette products in recent months, in turn causing shortages and resulting in an unprecedented rise of over 50% in the cost of tobacco since March.

Despite weighing just over 4% in Egypt’s inflation basket, tobacco has become — alongside food — a major contributor to price growth that hit records all through summer.

The intense surge is throwing off forecasts for inflation now topping an annual 37%. Many economists had expected it to peak months ago.

In an economy roiled by overseas commodity shocks and stalked by fears of another devaluation, the tobacco pinch is a case of what Egyptians bemoan as an endemic and often artificially created goods scarcity orchestrated by distributors or retailers to bid up prices.

“We had originally expected inflation to peak in June” and “our forecast’s error stemmed primarily from the sharp rise in tobacco prices,” said Mohamed Abu Basha, head of macroeconomic research at Cairo-based EFG Hermes. That climb “overshadowed a rather decelerating trend in monthly inflation.”

Tobacco prices are mostly set by the government and administered through Eastern Company, until recently wholly state-controlled. It increased prices in April by an average of 10%-11%, prompting agitation over yet further hikes.

As with key staples such as wheat, of which Egypt is one of the world’s biggest buyers, the country imports raw tobacco but produces cigarettes domestically.

Read More: UAE Firm Takes Stake in Egypt Tobacco Giant for $625 Million

Industry turmoil also reflects a dollar shortage that’s squeezed the $470 billion economy for over a year. Another dramatic devaluation may be needed to help ease the crunch, but such a move remains the biggest risk to inflation.

There’s “limited availability of foreign currency, impacting production of some cigarettes,” said Allen Sandeep, director of research at Naeem Holding in Cairo. Additionally, wholesalers have been “speculating about a hike in VAT and as a result are holding on to their inventory — if not raising prices as a prelude,” he said.

Eastern Company, in which a United Arab Emirates investment firm recently bought a 30% stake for $625 million, raised production twice in recent weeks in an attempt to tame prices. It blames some traders for gouging customers.

The UAE investor reached agreements with banks to make $150 million available for Eastern to fund raw-material imports.

That’s yet to be felt at Cairo’s kiosks.

“You get mad at me, yell at me — but what can I do?” a vendor named Ahmed told customers in the upscale Maadi neighborhood on a recent afternoon. Distributors’ hoarding of stocks and raising prices force him to pass on the costs, he said, declining to give his full name so he could speak freely.

While anecdotal evidence suggests prices are moderating, “speculation hasn’t fully faded,” Abu Basha said. More increases “though with a smaller magnitude can’t be ruled out.”

--With assistance from Tarek El-Tablawy and Abeer Abu Omar.

©2023 Bloomberg L.P.