Mar 4, 2020

EU Weighs Tougher Bank-Failure Rules After Fury Over Bailouts

, Bloomberg News

(Bloomberg) --

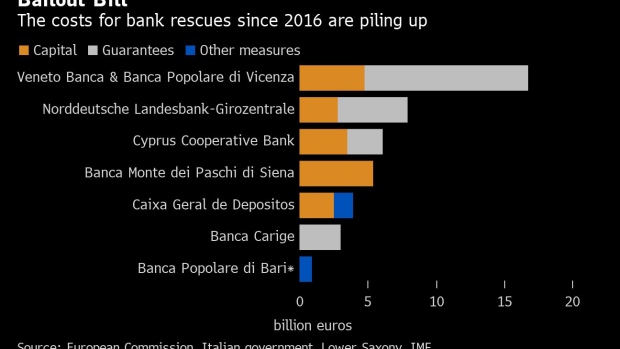

European Union officials are weighing measures to crack down on the use of taxpayer cash to fund bank rescues after a string of bailouts raised questions about countries contravening EU rules.

One focus of the discussions is the so-called “precautionary recapitalization” rule that Italy used to inject 5.4 billion euros ($6 billion) into Banca Monte dei Paschi di Siena SpA in 2017, according to an internal document written by European Commission staff and seen by Bloomberg. Officials are considering tightening the rules to avoid aid being given to a bank close to collapse.

After governments used almost 2 trillion euros of public funds to prop up European banks after the financial crisis, the EU introduced new rules meant to make investors bear the costs of a failing institution. Since then, politicians have injected tens of billions of euros of public funds into struggling lenders, prompting fierce criticism from lawmakers and public-interest groups.

Most recently, Germany agreed to a 3.6 billion-euro rescue of Norddeutsche Landesbank-Girozentrale, a lender in the country’s north that had been weighed down by toxic shipping loans. Italian politicians have also said they were ready to help Banca Carige SpA when the bank faced capital pressure last year.

The commission document focuses on the funding that EU rules allow to be given to banks that are still solvent. The law lists a range of conditions that need to be met so that the exemption isn’t abused -- for example, the funds can only be used to cover future losses of a bank, not past ones.

Experience with the rule “provided some insight on elements that may need to be further clarified or adjusted,” according to the commission. Specifically, it’s seeking feedback on whether there should be a clearer definition of what is a “solvent” bank, so that aid isn’t given to a firm that’s already breaching capital requirements or likely to do so in near future.

A spokesperson for the commission in Brussels declined to comment.

It also says that the balance-sheet checks conducted in the context of recapitalizations may have to be revamped to better divide a bank’s past losses from future ones. This could be a safeguard against public funds being used to cover losses that an lender has already incurred, for example through bad loans.

Sean Berrigan, a senior official at the commission, said at an event on Tuesday that the EU executive is “starting the internal reflection” on the bloc’s methodology for dealing with failing banks. “Hopefully we’ll come forward with something on that, but not in the very near term,” he told a conference in Brussels.

Any changes are likely to face intense debate with European governments and may take months or even years to agree. They could also feature as part of talks over German Finance Minister Olaf Scholz’s plan to fix the fragmentation of European banking markets.

--With assistance from Silla Brush, Nicholas Comfort and Sonia Sirletti.

To contact the reporter on this story: Alexander Weber in Brussels at aweber45@bloomberg.net

To contact the editors responsible for this story: Dale Crofts at dcrofts@bloomberg.net, Ross Larsen

©2020 Bloomberg L.P.