Jan 17, 2023

Euro Area’s Best Bond Trade of the Year Is at Risk of Unwinding

, Bloomberg News

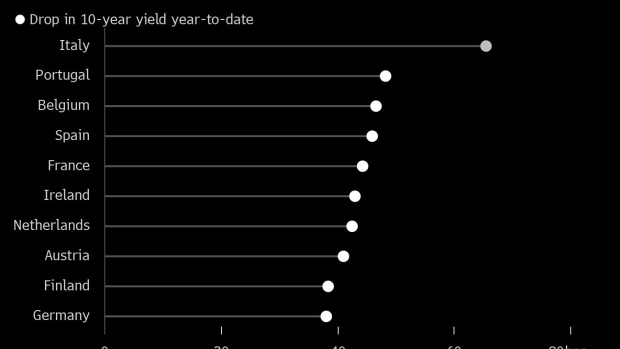

(Bloomberg) -- Investors are looking to bet against Italy’s peer-beating bond rally, saying the gains have gone too far.

They argue the European Central Bank is expected to keep hiking interest rates and is unlikely to stand in the way of a selloff given how narrow the spread over German bunds remains. In this camp are Lombard Odier and Royal London Asset Management, while BlueBay Asset Management is considering joining them.

It’s still a contrarian view. The year kicked off with money being ploughed into global bonds, and speculation that waning inflation will allow central banks to slow the pace of rate hikes. But with the 10-year yield on Italy’s sovereign debt, or BTPs, trading near the smallest premium to German bunds in nine months, the market looks primed for a correction to some.

“This level of BTP-bund seems to be underpricing the risk,” said Royal London fund manager Gareth Hill, referring to the spread between the two. “We are in an environment where the ECB is going to be tightening policy and the inflation problem in Europe is still there.”

Italy is one of Europe’s most indebted nations, with debt around 1.5 times the size of its economy, making it among the most sensitive to higher borrowing costs. The region’s core inflation is at a record and officials are insisting there are still “significant” rate rises ahead.

Investors will be watching for any further hawkish-sounding comments from policy makers. The ECB is no longer propping up the market by buying bonds and Italy could find selling bonds “particularly challenging” given its 227 billion euros ($246 billion) of refinancing needs this year, according to Goldman Sachs.

There’s also the risk of any flare-up in tensions with Russia over energy supplies, due to Italy’s outsized dependence on natural gas.

“Spreads are too tight and should widen from current levels,” said Mohit Kumar, a rates strategist at Jefferies, who recommends a small widener position and is looking to increase exposure toward the end of the month.

ECB Sees ‘Very Strong’ Wage Growth Ahead as More Hikes Planned

Not everyone is convinced now is the right time to short Italy’s debt however. The region’s government bonds could keep rallying if euro-area inflation slows rapidly in February and March, according to BlueBay.

“Other shorts will get stopped out,” said portfolio manager Kaspar Hense, who sees the Italy-Germany yield spread potentially reaching 150 basis points in that scenario. At that juncture, “it makes sense to implement a short.”

Societe Generale SA strategists said that declining rates volatility could pave the way for Italy’s yield spread to Germany to decline further. Bank of America Corp. analysts are refraining from recommending bets on a widening spread given they say a lot of traders are still buying Italian debt to cover previous short positions.

That drove the gap between 10-year Italian and German bonds down by as much as 37 basis points this year to less than 180 basis points, the lowest since April. Italy’s outperformance gathered momentum after Germany said it seek further joint financing plans within the European Union, which would help confidence in more indebted member states.

Very Sensible

Italy’s 10-year bond yield — at just over 4% — is well below the 5% level that could trigger concerns for investors over the sustainability of its debt load, according to BlueBay.

Those taking short positions have confidence the spread can widen plenty before it leads to any ECB intervention. Goldman Sachs Group strategists, for example, see the spread rising to 235 basis points.

A new ECB bond-crisis fighting tool is “is really out of the money so that’s why we think running these trades at the current levels is very sensible,” said Lombard Odier portfolio manager Nic Hoogewijs. He doesn’t see the ECB’s Transmission Protection Instrument — a tool to mitigate financial stress — being triggered until the 10-year Italy-Germany spread hits 300 basis points.

©2023 Bloomberg L.P.