Mar 15, 2021

Euro Finance Chief Sees Need for Fiscal Aid Even as Crisis Fades

, Bloomberg News

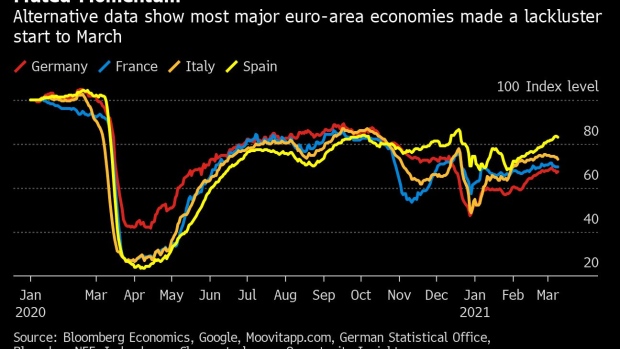

(Bloomberg) -- Euro-area governments should be ready to keep up emergency support for their economies even after the worst of the coronavirus crisis is behind them, according to the official who leads meetings of the region’s finance ministers.

Speaking before chairing a virtual gathering of his counterparts on Monday, Paschal Donohoe warned that the currency zone will require ongoing aid as it recovers lost ground to reach its pre-pandemic growth levels.

“There will be a need for the euro area and for finance ministers to continue to support our economies beyond the acute emergency of large parts of last year and parts of this year,” the so-called Eurogroup president said in an interview. “The risk and consequences of cutting support too early are currently bigger than the risks of pulling support too late.”

Donohoe, who is also Ireland’s finance minister, spoke before a discussion with colleagues that is expected to result in a pledge to keep fiscal policy in the region supportive through next year, and to only gradually ease support for businesses and workers.

Such a commitment would help cement more aid that already totaled about 8% of euro zone output in 2020, along with a new stimulus fund and liquidity schemes worth around a fifth of gross domestic product. To allow that support, the European Commission this month signaled it will extend its suspension of rules limiting debt through next year.

While maintaining fiscal aid, finance ministers are also looking at how to shift from blanket measures to more targeted ones, and how this will impact some areas such as tourism more than others like manufacturing. The danger is that weaning firms off life support could lead to a surge in corporate insolvencies, job losses and bad loans.

Call for Agility

Donohoe said governments will need to focus on three factors that may vary across sectors: employment consequences, financial stress and the impact of public health measures that could stay in place in the medium term.

“One of the principles the Eurogroup will recognize is the need of agility and the need to recognize that there are sectors at the moment that will grow in their employment again,” he said. “But it’s likely that they could be very different to where they were versus the pre-pandemic era.”

The finance minister says that one challenge is that measures currently helping firms survive are suppressing financial-sector threats, so the effect of withdrawing them can’t be fully estimated yet.

“All I can do is acknowledge that it is a very significant risk for us,” Donohoe said. For now, he added, “we have a period of time in which we need to build a bridge between where we are now and to societies that are more broadly vaccinated than they are now.”

©2021 Bloomberg L.P.