Apr 14, 2023

Euro Now a Harbinger for an Emerging Currency Rally, Citi Says

, Bloomberg News

(Bloomberg) -- Strength in the euro is emboldening Citigroup Inc. strategists to boost their bullish call on emerging-market currencies.

The euro area’s brightening outlook and the likelihood of a shallow US recession suggest a “lack of catalysts” for a stronger dollar, the Citigroup team including Dirk Willer and Luis Costa said in a report.

The euro climbed to its highest level in a year against the dollar on Thursday as investors priced in a more hawkish path from the European Central Bank and the prospect that the Federal Reserve might be near the end of its aggressive tightening cycle.

“A divergence in EU-US economic surprises and relatively hawkish ECB should support EUR versus USD, and boost EMFX,” the Citigroup strategists wrote in their Thursday report.

With the euro’s short-term “upside bias” set to support the currencies of eastern Europe against the greenback, the strategists established short dollar positions against the Hungarian forint and the Czech koruna in their model bond portfolio.

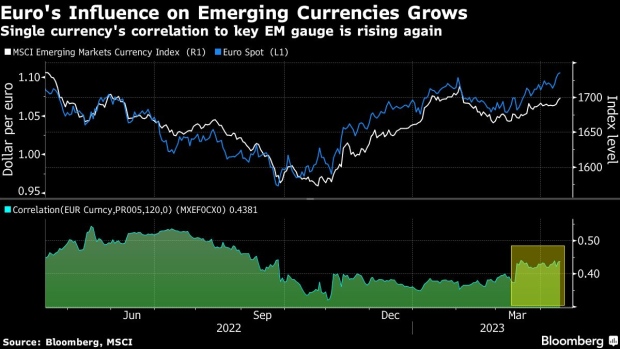

The forint, koruna and Polish zloty have been some of the biggest gainers among developing peers in the past month, climbing at least 4% against a sliding dollar. The correlation between emerging-market currencies and the euro has been rising since mid-March, when the single currency resumed its ascent following a hiatus.

Meantime, China’s recovery remains on track, providing an additional tailwind for emerging currencies, especially those in Latin America, according to Citigroup. While the bank’s economists are predicting a US recession in the second half of the year following the banking crisis and the reduced availability of credit, it’s unlikely to drag down the EU or “undermine Chinese growth too much,” the strategists said.

“It will therefore be a US-only recession,” they said. “Weaker US data surprises and background fears of banking stress will keep downward pressure on US rates as the market’s expectations for the Fed to turn dovish increase, and therefore EM duration should be well supported” heading into the second half of the year.

The strategists added Chilean peso exposure to their bond portfolio along with an outright short position in the dollar against the peso after a key gauge of US inflation showed hints of moderating in March.

©2023 Bloomberg L.P.