Jan 20, 2023

Euro’s Days of Muted Swings Look Numbered

, Bloomberg News

(Bloomberg) -- Currency traders are betting that the euro will see another bout of violent swings as European Central Bank hawks keep the focus on raising interest rates.

Movements in the euro have been subdued after a tumultuous 2022, with some investors backing a view that things will quieten down now that inflation is easing and the Federal Reserve is taking its foot off the gas on rate hikes.

Yet European policy makers keep pushing back against that market positioning. That’s leading currency players to think it’s worth starting to bet on greater swings.

“With hawkish comments from the ECB, and more hikes in Europe to come now, there will be likely more turbulence in euro-area rates, which is likely to be channeled into euro-dollar FX volatility,” said Olivier Korber, a currency and derivatives strategist at Societe Generale.

The common currency traded little changed at $1.0823 on Friday.

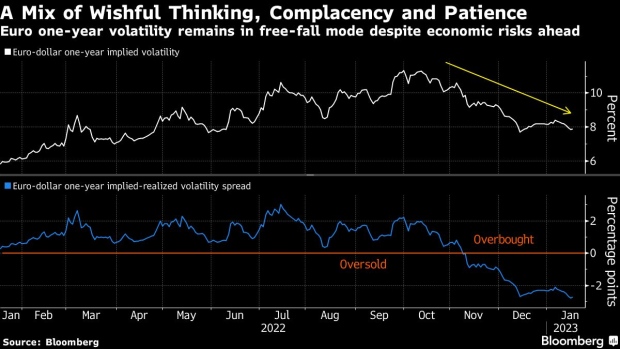

Implied volatility over the next year is below its past-year average at under 8%, after surging above 11% in the wake of Russia’s invasion of Ukraine. That looks like an opportunity to hedge risks, said Korber.

This week alone has brought several surprises for euro traders. First came a report that the ECB is considering a slower pace of interest-rate hikes, driving down the currency Tuesday, before a recovery Wednesday as weaker-than-expected US economic data hit the dollar.

Then a series of ECB speakers insisted policy makers won’t let up in efforts to return inflation to their target, given prices remain far too elevated, with President Christine Lagarde telling Davos that “stay the course” was her new mantra. That led a gauge of one-year volatility to rise Friday as traders amped up bets on rate hikes.

“The major risks to the drop in long-term volatility include unexpected news regarding the Fed or the ECB, prompting a repricing of current market expectations,” said Roberto Mialich, a foreign-exchange strategist at UniCredit SpA. “That’s as well as the usual lingering risks from geopolitics or Covid-19 contagion.”

Lagarde Says Inflation Way Too High, ECB to Stay the Course

Global currency volatility, as measured by a JPMorgan Chase & Co. index, has dropped this year after sliding in the fourth quarter of 2022 at the fastest pace since the aftermath of the pandemic. For the euro, it’s been an even sharper move — the quarterly slide in implied volatility was the biggest on record.

Even so, actual or realized volatility in the past year has been much higher, at well above 10%. The gap between the two now suggests that the options are at the most underpriced levels since the global financial crisis. That in itself could see some traders opt for relatively cheap bets to get exposure to being long volatility.

Oliver Brennan, currency volatility strategist at BNP Paribas SA, also thinks there is room for implied euro volatility to move up, given it’s among the lowest among the Group-of-10 currencies. There’s a minimal premium built in for risks around any escalation of the war in Ukraine and energy prices, he said.

There are plenty of people warning about complacency. Some of the world’s largest asset managers such as BlackRock Inc., Fidelity Investments and Carmignac worry markets are underestimating both inflation and the ultimate peak of rates, just like a year ago. That will leave traders glued to data, such as for US employment.

“A few weaker prints could be a catalyst for longer-term volatility to bounce back,” said Tim Brooks, head of currency options trading at market-maker Optiver. While a slow cutting cycle from the Fed would reduce volatility, “other central banks’ actions could be a far greater driver this year,” he said.

JPMorgan’s Michele Says Don’t Get Blindsided by Cooling Prices

Positioning could also exacerbate moves. Money markets are pricing in the ECB rate peaking in July and then the Fed cutting by the end of this year, while options traders have switched to bet on a weaker dollar. Both of these have been suppressing longer-term volatility.

“Such positioning suggests a pro-risk consensus is building, meaning adverse risks could create large shocks,” said BNP Paribas’ Brennan.

(Updates market pricing)

©2023 Bloomberg L.P.