Feb 1, 2023

Euro-Zone Inflation Eases as ECB Debate Over Rates Heats Up

, Bloomberg News

(Bloomberg) -- Euro-area inflation slowed more than expected, suggesting a more heated debate to come at the European Central Bank over how much further interest rates must rise.

January’s reading came in at 8.5%, Eurostat said Wednesday, less than economist estimates for a slowdown to 8.9%.

The third monthly retreat was driven by energy. But a gauge of underlying inflation that excludes volatile items like that held at an all-time high of 5.2%.

The data may embolden more dovish officials at the ECB who are starting to push for an easing in the pace of rate hikes following a widely anticipated half-point move on Thursday.

They can point to plunging natural gas prices amid a mild winter, as well as expectations of a similar downshift by the Federal Reserve and a pause in the Bank of Canada’s monetary-tightening cycle.

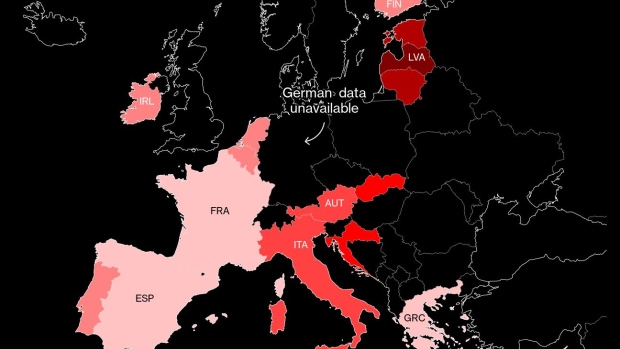

The Eurostat numbers estimate for Germany — which will release delayed inflation data next week.

More hawkish ECB officials fret about rising wages and have focused on sticky core inflation. President Christine Lagarde warned in December that there’s “good reason to believe” inflation numbers in the first two months of 2023 could be higher.

A rosier economic backdrop could strengthen price pressures. Data this week suggested the euro-region economy will dodge a recession, while the manufacturing industry is recovering and unemployment held at a record-low in December.

What Bloomberg Economics Says...

“This first release for the year is rife with uncertainty and we don’t expect the ECB will read too much into it. But, combined with stronger-than-expected growth in the fourth quarter, it should offer some confirmation that the big picture of persistent underlying price pressures remains valid going into Thursday’s meeting.”

—Maeva Cousin, senior euro-area economist.

Uncertainty over inflation was already elevated due to annual adjustments in how changes are calculated, as well as shifts in how some governments shield households and firms from the ramp-up in energy costs that followed Russia’s invasion of Ukraine.

The picture became even more cloudy when statisticians in Germany said technical problems meant they couldn’t provide January figures as scheduled this week. Eurostat has, instead, made its own estimate for Europe’s biggest economy, though it didn’t specify what that was.

The aggregate data suggest a sharp German slowdown, while analysts — surveyed before the postponement was announced — predicted an uptick. Eurostat’s final inflation reading is due Feb. 23.

The results of what’s already the most aggressive bout of tightening in ECB history are unlikely to become fully visible until the second half of the year. Attention this week will be firmly on Lagarde, and what she sees happening at March’s meeting and beyond.

The ECB will probably deliver 50 basis-point rate increases in February and March, followed by a final 25 basis-point hike in May, according to a Bloomberg poll of economists that sees the deposit rate then settling at 3.25%, up from 2% now.

Officials “will stay the course to ensure the timely return of inflation to our target” of 2%, Lagarde told the World Economic Forum in Davos last month.

--With assistance from Alexander Weber, Craig Stirling, Joel Rinneby and Barbara Sladkowska.

(Updates with Bloomberg Economics after seventh paragraph.)

©2023 Bloomberg L.P.