May 3, 2023

Europe’s Banks See Drop in Loan Demand But Stay Upbeat on Profit

, Bloomberg News

(Bloomberg) -- Banks in Europe are facing flagging demand for loans amid rising borrowing costs and industry turmoil, but they remain optimistic about profitability from higher lending rates.

HSBC Holdings Plc Chief Executive Officer Noel Quinn this week said loan growth was “subdued” in the first quarter and may stay so for three more months. UniCredit Spa and Deutsche Bank reported lower loan volumes, while the German lender said it’s planning to cut back its mortgage business as rising rates bite.

“I am a bit cautious on the near-term loan growth,” Quinn said in post-earnings comments Tuesday, adding HSBC hasn’t given a definitive guidance for loan growth because of the economic environment. “There’s a level of nervousness out there in the corporate world about taking long-term investment decisions in fixed capital.”

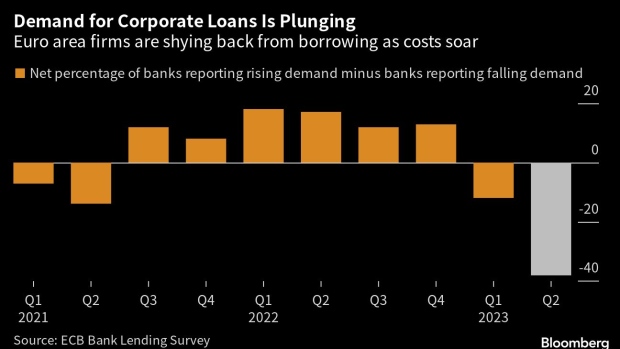

Households and companies are curtailing borrowing as a brisk pace of interest-rate increases by many central banks around the world has driven up funding costs. The share of euro area banks reporting falling demand for corporate loans in the first quarter was the highest since 2009, according to the latest bank lending survey published by the European Central Bank on Tuesday. Mortgage demand continued to plunge at the rapid clip seen in the previous quarter.

Yet the gloomy economic prospects aren’t discouraging lenders from giving out buoyant forecasts for revenue and income.

The overwhelming majority of banks queried in the ECB’s lending survey said that the rising rates will continue to improve their profitability, largely thanks to growing net interest income and higher margins, though declining demand was seen as a bit of a damper.

UniCredit ratcheted up its full-year guidance for net interest income by over €1 billion ($1.1 billion) after reporting a 44% surge in the metric between January and March. Deutsche Bank last week similarly said that tailwind from rising rates may enable it to exceed its 2025 revenue target.

Barclays Plc, NatWest Group Plc and Banco Santander SA were among banks that reported a jump in their net interest incomes in the first quarter. However, Lloyds Banking Group Plc, the UK’s biggest mortgage lender, said loan impairments are increasing and added that the benefits from rate hikes may have peaked.

“Higher interest rates — driving a lethal cocktail of credit risk, tighter household finances, falling house prices and rising commercial real estate challenges — are prompting banks across Europe to tighten their credit standards in 2023,” Bloomberg Intelligence analysts led by Philip Richards said in a note on Wednesday.

Loan growth to the euro area’s private sector slowed for a sixth consecutive month in March, another set of ECB statistics showed Wednesday.

While higher rates have boosted profits at banks largely thanks to the widening spread over what they earn on loans and pay for deposits, they’ve also had negative side effects. Those include a plunge in the value of government bonds held on balance sheets and customers moving their money to assets offering better returns.

Both UniCredit and Deutsche Bank said the rates they need to offer to keep depositors is still way below their initial planning, providing a lasting boost to net interest income. However, Deutsche Bank also said it recently accelerated the pace of increases as competition for deposits heats up.

©2023 Bloomberg L.P.