Aug 1, 2022

Europe’s Bond Agony Eases After Best Monthly Return on Record

, Bloomberg News

(Bloomberg) -- After an excruciating start to the year, the European debt market has finally won some respite.

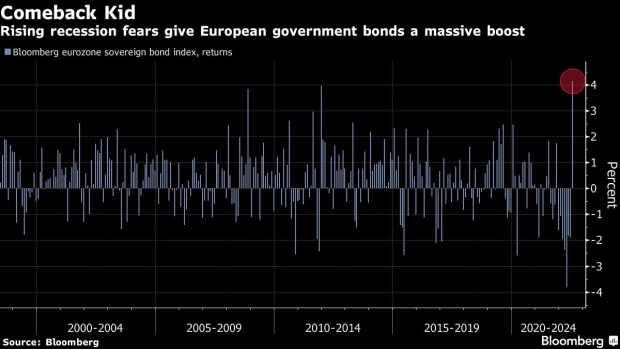

A Bloomberg index tracking euro-zone sovereign bonds posted a return of 4.1% in July, its best monthly performance on record, according to data compiled by Bloomberg. That puts an end to seven consecutive months of losses as record inflation battered fixed income, prompting investors to dump their holdings en masse.

Returns year-to-date are still woeful at almost minus 9%. But it’s a sign that the asset class has won back some appeal after the monster rout left yields looking their most attractive in years and an economic downturn fuels demand for haven assets.

“The European bond market has become attractive again,” said Nicolas Forest, head of global fixed income at Candriam, which manages 158 billion euros ($162 billion) of assets. “The risk of recession has become the main risk for bond investors, and we believe that the best instrument to hedge against a recession is government bonds.”

The asset class flipped back to a positive return the same month that the European Central Bank raised rates for the first time in over a decade. But money market bets on rate hikes are already showing signs of peaking, prompting RBC Capital Markets to cut its target for German 10-year yields to 0.8% from 1%. Yields have already more than halved since hitting 1.93% on June 16, the highest since 2014.

Read more: IMF Cuts World GDP Outlook a Third Time as Inflation, Rates Jump

Candriam favors long-dated German and French debt over short tenors given the curve would likely flatten further in a recession. The spread between two and 10-year German notes is now around 52 basis points, having flattened from above 80 in early July.

Lingering risks

There’s still plenty of caution around. Pascal Blanque, chairman of the Amundi Institute, warned that expectations of an imminent collapse in growth may be premature. That’s because the impact of tighter monetary policy takes time to filter through, while central banks may also baulk at inflicting too much pain on the economy.

“Inflation will therefore be higher than many expect over the next couple of years, with important implications for asset prices,” he wrote in a note to clients. “In fixed-income markets, this will mean even higher yields.”

Euro-area consumer prices have hit a fresh all-time high, data showed on Friday. While second-quarter growth in the region beat expectations, the figures also underlined the challenges, with top economy Germany unexpectedly stagnating. Euro-zone confidence has fallen to a 17-month low.

Paul Jackson, global head of asset allocation research at Invesco Asset Management Ltd, is more confident, seeing price pressures likely to ease as economies start to founder. The firm is overweight government bonds for the first time since 2016, though yields have dropped significantly since Jackson turned positive on the asset class in mid-June.

“I think the risks are now more evenly balanced between yields rebounding or going even lower,” he said.

Traders are wagering on far fewer hikes than they were, with about 100 basis points expected from the ECB by December. Data on Thursday showed the US economy shrank for a second straight quarter, fueling concerns a recession may spread to Europe, particularly if disruptions in Russian energy supplies worsen.

“The gas situation is hanging over Europe,” said UBS Group AG rates strategist Rohan Khanna. “Until that risk goes away and confidence makes a recovery, it will be quite difficult for yields to rescale the peaks seen earlier this year.”

©2022 Bloomberg L.P.