(Bloomberg) --

Europe’s bond markets look set to have a warm July as the European Central Bank’s asset purchases keep running and hefty government debt issuance slows down for the summer.

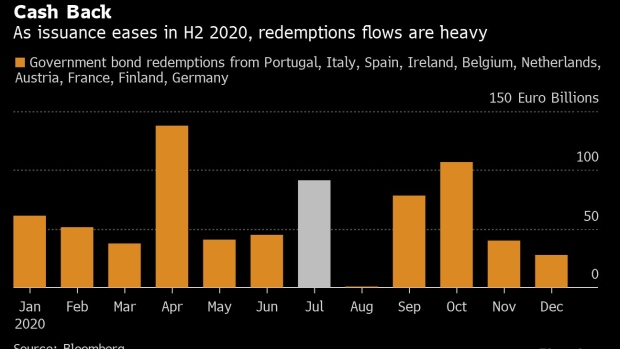

This month could see 57 billion euros ($64 billion) of spare cash chasing assets, according to Citigroup Inc.’s Saumesh Dutta, since the ECB’s buying along with coupon payments and redemptions to investors will more than soak up any debt sales.

That should be “very supportive” for European government bonds, particularly French ones, Dutta said in a note. The prospects for the remainder of the year are even better, according to Bank of America strategist Erjon Satko, who expects bond sales to be countered by cash in excess of 222 billion euros, the most since 2017.

“The size of reinvestment flows (including all ECB QE programs) are picking up materially in July, September and October,” Satko wrote in a note.

European bond investors will also be looking for progress on the European Union’s proposals for a coronavirus recovery fund next week, given member states remain deeply divided on the stimulus. Gilt traders will be watching U.K. Chancellor Rishi Sunak’s address to Parliament on July 8, when he is expected to announce new measures to boost the economy.

Slow Sales

Bond issuance next week is set to slow rapidly. Germany will offer a new five-year note, while Austria and Ireland also have sales, and there are no bond coupons or redemptions to be paid. Germany still has 150 billion euros of supply to be done in 2020, more than at this time last year, said Jorge Garayo, a rates strategist at Societe Generale SA.

Italy will sell a new BTP Futura bond to retail investors, demand for which is unpredictable, according to LSEG Borsa Italiana’s fixed-income head Pietro Poletto. There may be further opportunistic selling from its Treasury with a seven-year offering through banks.

U.K. debt sales are also set to slow, to 7 billion pounds across three sales, one of which is an inflation-linked bond.

- European Council president Charles Michel will unveil a compromise proposal on the recovery fund proposal next week

- Data for the coming week is thin and mostly relegated to second-tier, backward-looking figures, providing few clues on the state of economic recovery from the coronavirus pandemic

- Euro area Sentix investor confidence for July on Monday is the only forward-looking number; German factory orders for May are also published Monday followed by industrial production for the same month Tuesday

- The U.K.’s data calendar is also light, leaving investors to focus on June construction PMI numbers from Markit/CIPS on Monday after BOE policy maker Jonathan Haskel said some activity was returning to the housing market

- Fitch Ratings pre-empted Friday’s review of Italy in April, when the sovereign was downgraded to BBB- with a stable outlook; the agency said at the time that developments had warranted such a deviation from the calendar

©2020 Bloomberg L.P.