Jun 14, 2023

European Direct Lenders Weigh CLOs Option as Fund-Raising Stalls

, Bloomberg News

(Bloomberg) -- At least three direct lenders are looking at bundling up private credit into collateralized loan obligations as they seek new ways to tap pockets of capital, potentially kick-starting a fledgling European asset class in the process.

Tikehau Capital SCA, Eurazeo SE and Pemberton Asset Management are among the firms exploring how to craft CLOs from the loans they’ve made to small- and medium-sized companies, according to people familiar with the matter who are not authorized to speak publicly. The idea is to attract traditional CLO investors to a private credit strategy.

Typically, CLOs buy corporate leveraged loans arranged by banks in the public market and carve them up into bonds of varying degrees of risk and return.

The private credit variety is different because the loans repackaged to create them are made by direct lending firms. Unlike the credit facilities bundled up into ordinary CLOs, they’re not sold on by banks to investors in the leveraged loan market, but are held to maturity instead. After more than a decade of growth in Europe, private credit’s foray into securitization represents another milestone in the development of the asset class.

Plans for the European deals are at an early stage and may not happen, according to the people familiar.

A representative for Pemberton and Tikehau declined to comment while spokespeople for Eurazeo didn’t immediately respond to a request for comment.

European Push

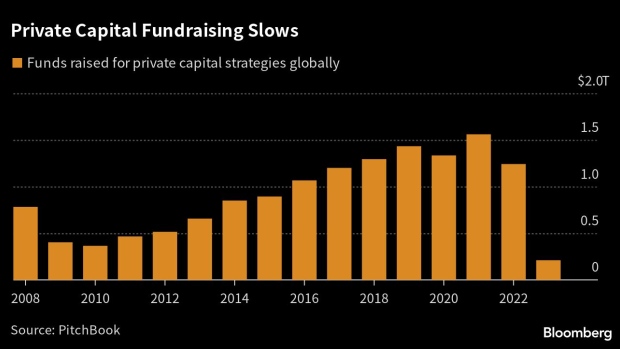

The push for European private credit CLOs is part of efforts by the industry to open up new sources of capital in the face of a global slowdown in fund-raising.

The $1.5 trillion private credit market has seen rapid growth as traditional lenders become more cautious about underwriting leveraged finance deals amid high inflation and sharp increases in interest rates. But by the same token, the volatility in public markets has made it harder for direct lenders to raise money.

The US has had a robust private credit CLO market for years, reaching $11.1 billion in volume so far in 2023, according to data compiled by Bloomberg.

But up to now, the asset class has struggled to take root in Europe. Investors typically have less appetite for risk, and direct lenders have had less need for the extra financing.

Fresh Capital

In the US, private credit CLOs can offer premiums of as much as 200 basis points compared with their garden-variety peers, but direct lenders hope the difference will be narrower for European deals.

If the difference between its CLO and one secured against broadly syndicated loans is as wide as 200 basis points, “that cost of funding probably wouldn’t work for us as private financing would be more efficient,” said Ravi Anand, managing director of ThinCats, a small direct lender that’s also exploring launching a private credit CLO.

There have been some past attempts in Europe to get a market for private credit CLOs off the ground. In 2019, Be-Spoke Capital, a direct lender focused on Spanish small businesses, priced a €280.5 million ($303 million) deal.

--With assistance from Silas Brown.

(Adds context on significance of private credit moving into CLOs)

©2023 Bloomberg L.P.