Dec 6, 2021

European Gas Heads Toward 2-Week Low as Supply Concerns Ease

, Bloomberg News

(Bloomberg) --

European natural gas futures headed for a third session of losses amid expectations for milder weather next week and more liquefied natural gas cargoes coming to the region.

Prices in the U.S. slumped, making LNG exports more profitable for local producers. On top of that, temperatures across mainland Europe are seen turning toward above-average levels by the end of next week after a cold spell in some parts of the continent.

“Weather remains an important risk,” Morgan Stanley analysts Igor Kuzmin and Chenshihui Lin wrote in a note Monday. Even so, LNG and Norwegian supplies are strong, while demand has declined, they said.

Dutch front-month gas, the European benchmark, fell as much as 4.9% to 85.10 euros a megawatt-hour, the lowest since Nov. 23, before paring some losses by 9 a.m. in Amsterdam. That follows a 5.6% decline on Friday. U.K. month-ahead gas traded 2.6% lower at 223 pence a therm.

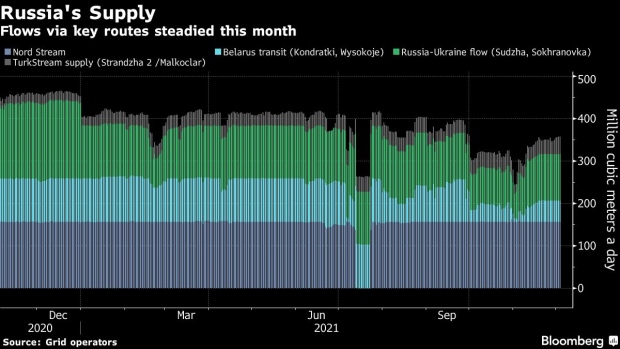

Gas flows from top provider Russia also remain steady so far this month, easing some concerns over a worsening supply crunch with Europe’s gas storage levels abnormally low.

Russia’s gas supplies to Europe increased slightly last month, but volumes remain “a far cry from what would have been needed to prevent storages from dropping further,” Axpo Solutions AG said in a report. “All this means gas storage will likely take more time to replenish after winter.”

©2021 Bloomberg L.P.