Sep 4, 2023

European Stocks Hold Steady as China Stimulus Lifts Miners

, Bloomberg News

(Bloomberg) -- European equities held steady as fresh Chinese stimulus measures aimed at supporting the country’s beleaguered property sector boosted miners and travel sectors, though worries over slowing economic growth kept gains in check.

The Stoxx Europe 600 closed little-changed in London after rallying as much as 0.9% earlier in the session, with volumes thin. China is taking bigger steps to showcase its policy determination after a slew of piecemeal measures to support the housing market failed to halt a slide. Basic resources shares, travel and technology stocks outperformed, while more defensive utilities lagged.

Read more: Stock Market Rally Set to Weather Higher Bond Yields: MLIV Pulse

In individual stock moves, Novo Nordisk A/S, which on Friday became Europe’s most valuable company, extended gains to a fresh record. Meanwhile, Banca Monte dei Paschi di Siena SpA fell amid concern by analysts and investors about the lack of a clear strategy for the state’s sale of its stake.

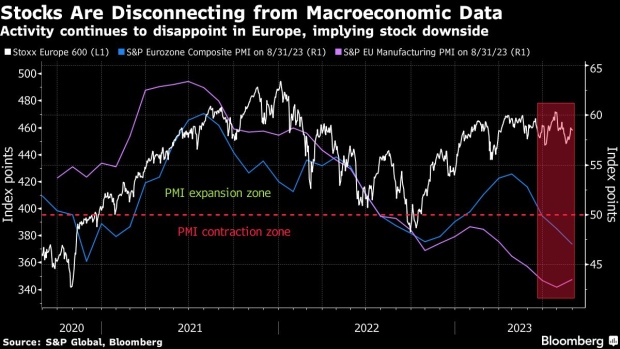

Further stimulus from China is significant as European stocks slid last month amid concerns about the Asian country’s economy, on top of worries rates will peak higher than expected. Investors are also fretting about slowing growth in the region while inflation remains above the European Central Bank target.

“The measures will be helpful to avoid a more severe and sudden decline in GDP growth, but Chinese consumption will inevitably slow down,” said Susana Cruz, a strategist at Liberum Capital. “In Europe, this will be particularly bad for luxury goods — with their second best market, the US, also losing momentum — and car manufacturers.”

Her team expects more domestically-oriented stocks to do better in the next month, as well as everyday discretionary consumption.

For more on equity markets:

- Betting Against Fear Has Really Paid Off This Year: Taking Stock

- M&A Watch Europe: Nestle Sells Business; Monte Paschi Clash

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika and Kit Rees.

©2023 Bloomberg L.P.