Jan 29, 2024

European Stocks Pause at 2022 High Ahead of Fed; Holcim Jumps

, Bloomberg News

(Bloomberg) -- European stocks edged higher on Monday, having touched a new two-year high, as the earnings season ticked on and investors waited for the Federal Reserve policy meeting later in the week.

The Stoxx 600 Index was 0.2% higher at the close in London. Gains were capped by jitters over the possible US response to attacks that killed American troops in Jordan and hit a fuel tanker in the Red Sea. Shares in European oil majors such as Shell Plc, TotalEnergies SE and BP Plc rose as geopolitical risks in the Middle East supported Brent crude prices above $82 a barrel. Telecoms sector slid.

Holcim Ltd. shares jumped after the Swiss building-materials announced that it intends to spin out its North America operations into a separate US-listed entity. In other notable moves, Royal Philips NV fell after the Dutch company said it was suspending sales of sleep apnea devices and ventilators in the US, while Ryanair Holdings Plc ended the day 4% higher after falling in earlier trading.

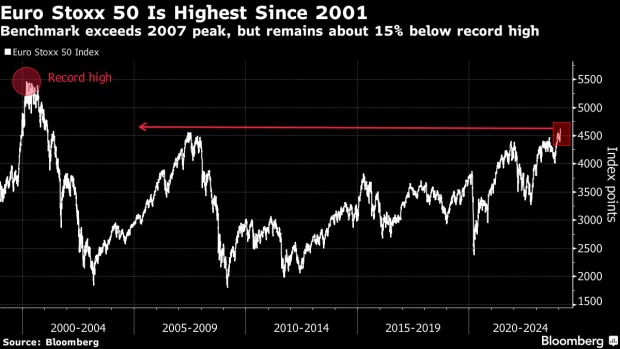

European equity markets are hovering at their highest level since January 2022 and have gained more than 1% year-to-date. The Euro Stoxx 50 index also at its highest since 2001, with the latest leg of the surge powered by blowout earnings from luxury behemoth LVMH and the region’s two biggest tech stocks, ASML and SAP.

“I would expect a little bit of digestion from the big move up on Friday but I haven’t seen anything over the weekend to scare investors off so I’m sticking to a positive bias.”, Harry Heneage, a sales trader at Kepler Cheuvreux’s KCx in London.

“It will be a very busy week with many possible market catalysts”, Heneage added, pointing out to a flurry of key US earnings including Microsoft and Meta as well as the meetings of the Fed and the Bank of England.

For more on equity markets:

- Europe’s Own Tech Stars Leading Index to Record: Taking Stock

- M&A Watch Europe: Holcim, Applus, Air Astana, Philips, BP

- US Stock Futures Fall

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.

©2024 Bloomberg L.P.